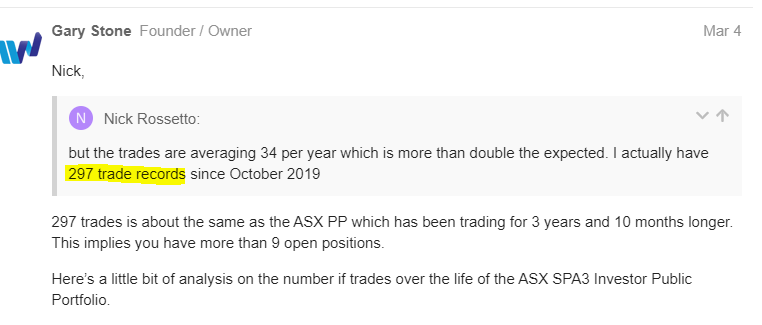

Nick,

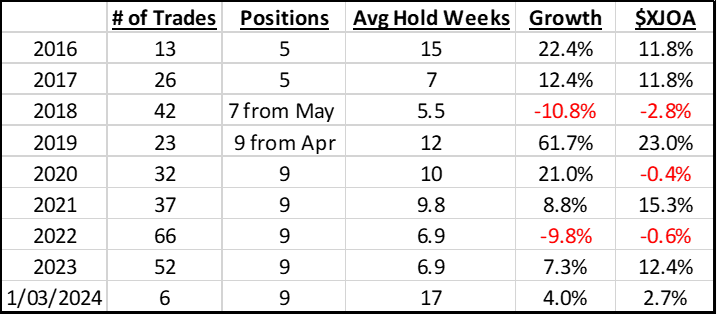

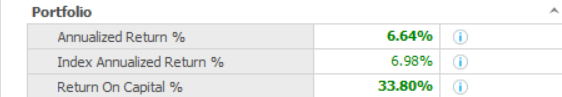

The Reward Objective has never been revised down. We have always spoken of aiming at 4% - 5% compounded p.a. better than the Total Return indices. This comes from the long-term average return of these indices being around 10% annualised.

In the Public Portfolio Investment Plans, from day 1 we have aimed at a Reward Objective, to measure how we’re doing over the long term, of being 4% annualised better than the Total Return indices.

When we first set this Objective, way back in the early 2000s with SPA3 Trader, we used rolling 5 year periods as the way to measure how we were doing.

With some input from long standing customers and some research on what other managed funds and industry Super Funds state for their funds’, especially All Share funds, as the minimum period to measure comparative performance to give any strategy enough time to play out in different market conditions, it seems that 7 years is the industry standard.

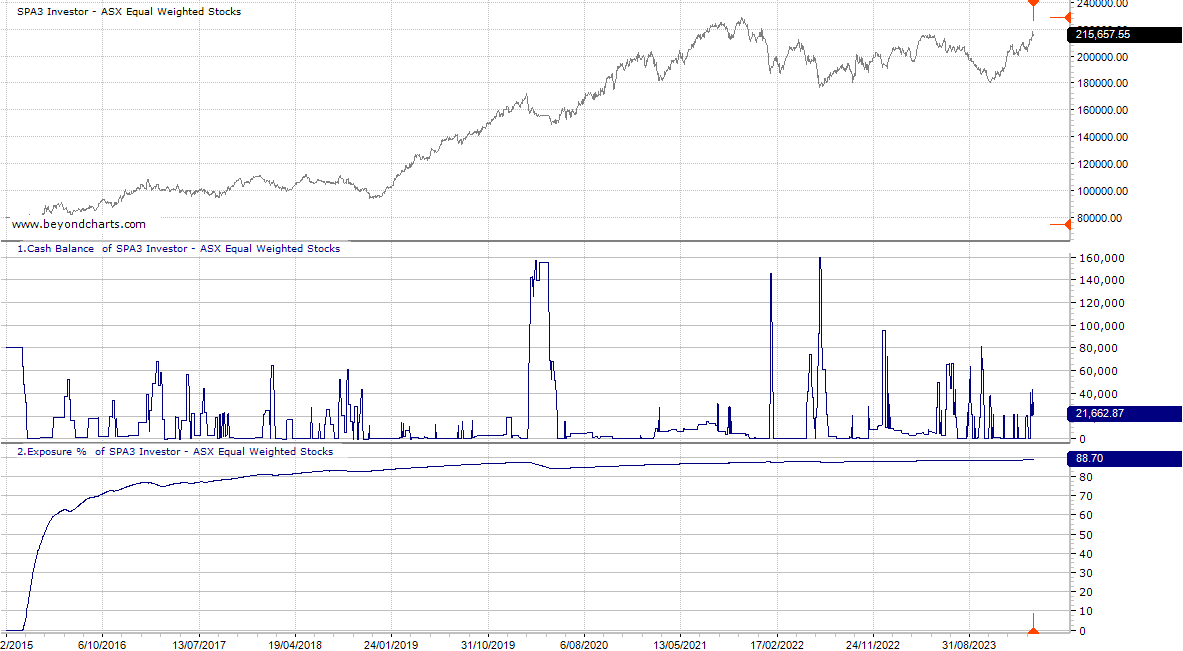

As performance is so market dependent, for a couple of decades I’ve also spoken of using 2 market runups and run downs of at least 10% for each, regardless of how long it takes, as a good ‘period’ for performance measurement. This is what should be used for backtesting a system, so this condition shouldn’t be any different in live trading.

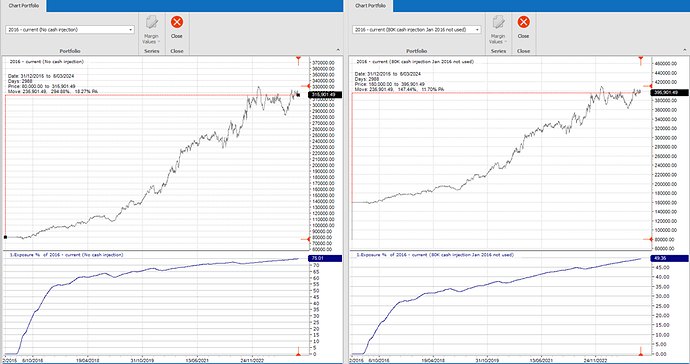

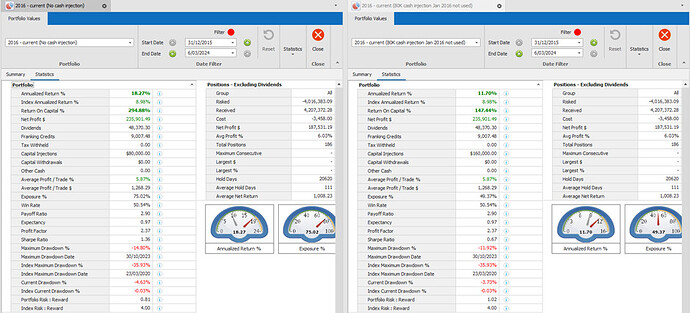

Regarding the 21% CAGR and 15% drawdown, this is the sort of simulated portfolio performance we look for, and achieved, in backtesting. We aim at this sort of level because we understand that historically known data will always be different to future unknown data, and that no mechanical system will perform at the same level in live trading as it does during historical research.

The 14% to 15% CAGR as a Reward Objective is around 2/3rds of the historically simulated portfolios to allow for this. And is also 4% to 5% better than a 10% annualised Total Return / Accumm index, over the long term.

Trust this makes sense and explains again where the 4% - 5% anualised better performance comes from as the aim for the Reward Objectives in the Public Portfolio Investment Plans. And over what time period and market conditions to allow it to play out.

That said, if the market does better or worse the 10% annualised over around 7 years, then we still have a relative Return to aim for of 4% to 5% better.

Of course, markets are volatile in the short term and portfolio performance can vary greatly for all sorts of reasons, including reasons related to and not related to the mechanical system.

Past performance is not a reliable indicator of future performance.