Hi everyone

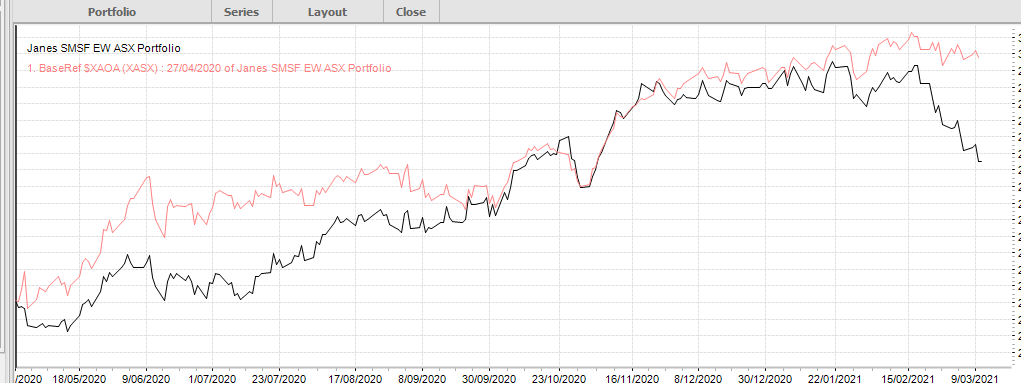

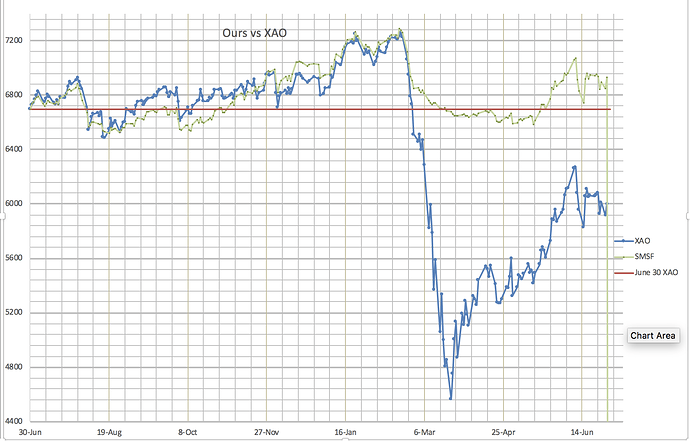

Thought I would chime in with my performance so far. I run 2 portfolios on the ASX with SPA3 Investor - one has recently increased from 11 to 12 stocks for the SMSF and the other has 8 positions (outside of super). Both started October 2019.

The larger portfolio has a Winrate of 45% and Profit Ratio of 1.7 so is profitable but only just. It has returned 14% at 11% CAGR.

The smaller one is at 55% WR and PR of 1.63. It has returned 21% at 14.6% CAGR

It’s early days of course and an edge can take a bit of time to play out but the Profit Ratio is materially below the high 2’s / 3 of the system and the market post Covid has been fairly strong up until this month.

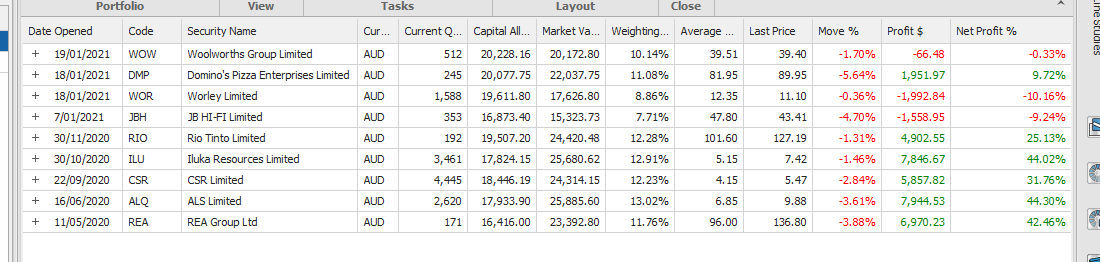

Both portfolios don’t take gold stocks nor Telstra and QBE but do take everything else. Both portfolios had the recent WOR large loss trade and I have had both FPH recent loss trades.

Closed trades include Friday’s signal prices so figures will alter slightly when the REA and ALQ exits get their actual traded prices Monday.

Both portfolios hold decent unrealised profit trades in JHX and the larger portfolio holds CSR as well. I was wondering if these figures compare ok to other members and if anyone wanted to discuss their own experiences.

There has been quite a bit of give back in the past few weeks too (in line with the market) but giveback (recent examples like JBH JHX DMP etc) is a characteristic of trend following systems otherwise you would never get the really big trends.

In regards behaviours, if I could critique my own performance over the past year or so it’s probably been fear of taking some trades like ILU / ANZ (loss avoidance) which have gone on to perform well. Everything else seems ok though - I am not holding stocks after exit signals or cutting profits short - average $ win is just too small.

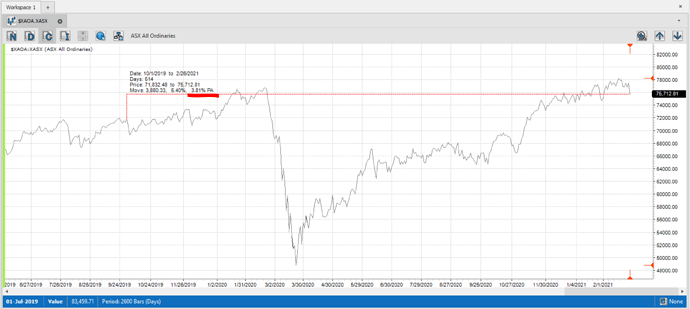

In addition, I can’t seem to reconcile the public portfolio in Trademaster so tried to look at it in Beyond Charts but it appeared to contain positions that should have been closed (JBH WOR and DMP)? It’s quite possible I am doing something wrong though.

My aim is to try to match / exceed the public portfolio performance over time.

Anyway I just wanted to touch base as trading can be a lonely endeavour!

Cheers all

Nick

Below is my snip of the Public Portfolio.

)

)