Thanks Paul and Nick, it will be interesting to watch over coming months/years how things progress. A few weeks ago I was up 30% since starting, which sounds awesome but it only reflects the ASX rise generally. Now with a few loss trades I am up 20% overall while the ASX 200 is still up nearly 30%. That’s a 50% difference in profit. I’m in it for the long haul, but I was considering putting more of our assets into SPA3 investor until recently but I think I will wait a bit longer.

Hi Neil,

If you look at the ASX equal weighted public portfolio, you will see that it is suffering from the same short term relative underperformance as yours is (my portfolio is experiencing the same effect). However, this is just one of the features that occur when trading the system; this has happened before in the life of the public portfolio but yet it has the overall performance curve which you can see.

These situations always feel worse when you are in the middle of them.

Regards

Don

Thanks Don, that was good advice to look at the public portfolio and overlay the same base reference - very enlightening, especially if you vary the reference date.

Cheers, Neil

Hi Neil,

Thanks for posting your comments.

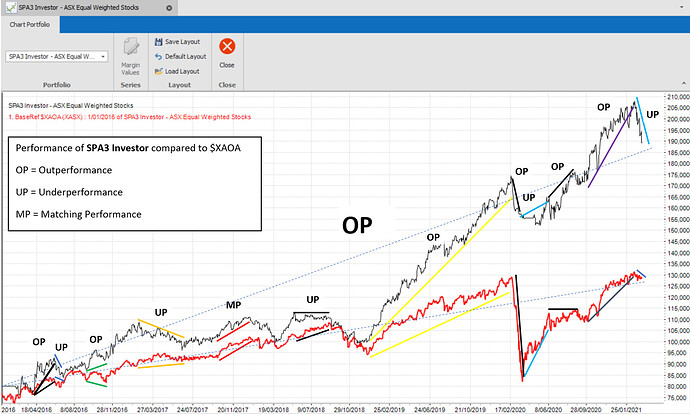

To provide a little context for your current experience I’m attaching an image of the ASX Equal Weighting Public Portfolio versus the All Ords accumulation index ($XAOA).

You’ll see that there are periods in which the public portfolio has outperformed, underperformed and matched the accumulation index. The order in which this occurs is very much random, however the relative size of the outperformance versus the matching and underperformance will be seen more clearly over a sufficiently large sample size.

For this reason we suggest a minimum investing horizon of 3 years, but preferably 5 years or more. Outperformance over the longer term timeframe is one of the 2 key objectives of SPA3 Investor. The other is protection against Sequence of Returns Risk.

In the SPA3 Investor process documents there is a step that suggests importing the SWS public portfolios for a comparative view of your portfolio’s performance. Currently the SWS ASX Equal weighted stocks portfolio is in drawdown approximately 9% from it’s most recent peak. My own portfolio is down by a similar amount.

Draw down is unavoidable and the length and depth of each period will be unique. The worst thing an investor can do is withdraw from the market into cash during a draw down when no exit signals have been triggered, and then the market rallies to make a new market high and you have no exposure to the rally.

In the chart attached you’ll see periods where the public portfolio equity curve is in drawdown (sloping down) whilst the benchmark is also sloping up, representing periods of underperformance. Other times you’ll see where the public portfolio is sloping up, and the benchmark is also sloping up, but at a greatly reduced angle. This represents outperformance. The more one focuses on short term periods for comparison the greater the number of “mini” periods of outperformance, underperformance and matching performance.

It’s the volatility of individual stocks that provides the growth element for a SPA3 Investor portfolio. As such the longer term equity curve will be steeper than the index (which is diversified). On the flip side of this, the benchmark equity curve is likely to be a little smoother due to its diversification and it’s longer term performance lessened as a result. The chart above illustrates this well.

The first lesson in “Back to Basics” covers this important topic and provides some very useful tips for understanding draw down and ways to help process various thoughts that might arise when first starting out. Here’s a link to that lesson.

Focussing on short term outcomes is likely to give them energy, until you’ve learned how to train your mind to think in terms of probabilities and how an edge works over the longer term. Even an Investment in a managed fund requires 3 to 5 years as a minimum.

Thanks David, that’s a really interesting chart with the various OP, UP and MP periods drawn onto it. It appears that the last few weeks is the steepest and deepest underperforming drawdown period since the portfolio was established. Don’t worry, I won’t be going against any of the signals - I’m in it for the long haul.

Cheers, Neil

Hi Neil,

I should have used a semi-log chart for the illustration as it does look as though the portfolio is having a larger drawdown than in COVID. This isn’t the case.

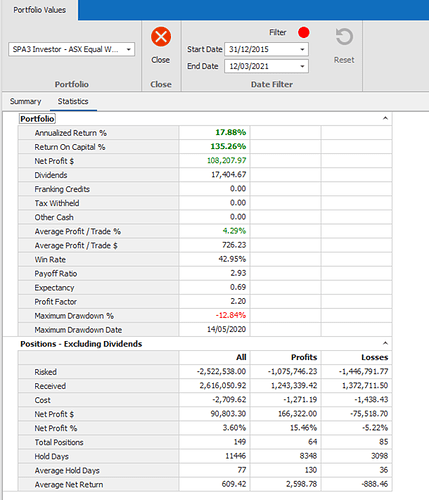

If you import the public portfolio and then go to the values tab and select the ASX EW portfolio it will produce a summary page with a statistics tab.

If you click on the statistics tab you’ll see the largest draw down was -12.84% and occurred on the 14th May 2020.

By comparison the All Ords accumulation index experienced a -36.48% drawdown on the 23rd March, 2020.

Regards,

David.

It is interesting to read the feedback. I think the time that the portfolio starts and the initial performance makes a huge difference to psychology. It is a lot easier to give back some profits in a drawdown than starting by loosing your base capital. Eg if you bought CBA at $25 per share and watched it go to the mid $80’s to then go into a drawdown is a lot easier then watching your original $25 go straight to $20.

I only started late in 2020 and perhaps I was too enthusiastic. I opened 3 portfolios, ASX Trader, ASX Investor and NASDQ Investor. I had been following the rules to the letter. ASX Trader and NASDQ Investor are now high risk. All 3 portfolios have lost money and overall my win rate was about 20%. I understand that I have only had 43 closed trades. But I now have 5.6% less than I started with on the ASX investor and 3.8% less than I started in the ASX Trader portfolios and my “best” portfolio is the NASDQ Investor portfolio where I have 1.77% less than I started.

All portfolios have considerably underperformed their respective indexes. I realise that I need to run the process for 5 years to see the edge but given the rate that I am loosing money I am not sure I can afford to. I fear blowing up my accounts and loosing my hard earned assets. I had been using selfWealth online brokers and they provide daily chart for your portfolio v/s the index. Most days my portfolio performed worse than the index. Also I received frequent notifications from SelfWealth stating that I was in the bottom 25% of their investors.

Hence I have decided to close all the portfolios for the moment and paper trade and see if that will increase my confidence in the system.

Ivor

Ivor,

When one starts a portfolio can definitely have a huge effect on one’s investing psychology.

Your CBA example definitely applies to most human beings, especially those that have difficulty understanding how to invest by thinking in terms of probabilities.

Here’s a question for all readers of Ivor’s and this Post to reflect on…

…if you were managing a discretionary portfolio by sourcing your ‘trade ideas’ from various sources (not from a mechanical system of any sort, but rather from brokers, newsletters, Spotee on Ticker NEWS, mates, family, a forum) and you found yourself in this exact position, what COULD you do?

Write down some answers of different actions you could take. Take no more than 5 mins, i.e. off the top of your head without doing any research on the internet.

Then see yourself in this situation - you manage a portfolio using a single source, a mechanical system that has a known statistical edge. Now write down what you SHOULD do. Take no more than 1 minute.

Now write down WHY you are not doing what you should do?

That’s what you need to work on to improve as an investor.

It so happens that the Connect & Grow webinar that I’ll be presenting this Wednesday will include coverage of this situation that Ivor has described. I will attack this subject from a different angle to what I have in the past. I have called it “Order from Chaos in the Financial Markets”.

No, I won’t be singing any heavy metal songs…

Regards

Gary

Hi Ivor,

Reading your post resonated with me and had me experiencing “flashbacks” to over a decade ago. I trust the story of my journey over the past dozen or so years will help clarify your thoughts and your understanding of what we must do when actively mechanically investing using a back-tested and researched “edge”.

What you are experiencing is exactly what I experienced when I first signed up for Sharewealth Systems around 2008. I started trading using SPA3 Trader in a market that was similar to the one we have experienced in recent weeks. I immediately went backwards losing similar %’s of capital, got cold feet and stopped trading after a few months. In hindsight, for me it was the wrong thing to do!

Fast forward about 10 years, I recommenced trading with SPA3 Investor, after having spent the best part of a decade “in the wilderness". While “wandering around in the wilderness” & having gone further backwards in terms of my investable capital, the returns generated by the public portfolios of SPA3 Trader and SPA3 Investor over the intervening period left me “crying in my proverbial beer”. While I would not have exactly matched the performance of the public portfolios, I would achieved similar if I followed the rules mechanically. Maybe more, maybe less. The experience taught me some major lessons! These lessons were driven home when I re-read “Trading in the Zone” by Mark Douglas a second and third time 2 years ago.

I first read Mark Douglas’s book, “Trading in the Zone” over 15 years ago when it was first published. At the time, I did not really “get it”. So I re-read it twice a couple of years ago, and literally had an epiphany. The main lessons I got from Mark Douglas were…

- When using a researched and back-tested mechanical trading system, I must always think in terms of “probabilities”.

- My improved understanding of the 5 fundamental truths.

Gary Stone and David McCullough have been saying the same things repeatedly in their webinars and various correspondences to ShareWealth subscribers for a long time as well.

These lessons mentioned above have liberated me to just take the signals as they arrive without any fear whatsoever. I now understand that I am like the croupier at the blackjack table at the casino, that I am now ‘the House”. Without a trading system with a researched edge, I am just like the punter at the casino, riding my luck in the short term, and likely to be slowly but surely fleeced of my money over the longer term as the House’s edge plays out against me. The croupier at the blackjack table mechanically deals out the next hand, then the next, then the next, regardless of the run of consecutive losses the House may suffer in the short term. The House knows it has the “edge” which will reveal itself over a large sample of hands. Likewise, it is my job to mechanically take the next signal, then the next, then the next, and to do it without emotion, whether the previous bunch of trades were favourable or un-favourable to my equity curve. It is my job to simply find out if a trade is a winner or a loser, and mechanically follow the system’s signals. That’s it. The system’s edge will eventually reveal itself over a large sample of trades.

I restarted with SPA3 Investor in mid 2017 and my equity curve is positive but currently in drawdown. I also commenced 2 other portfolios in Dec20 and Feb21 and like you, the equity curve for both has gone backwards from the start. However, it is possible the market could take off tomorrow. “Anything can happen”, to quote Mark Douglas’s First Fundamental Truth. And I want to catch that wave if it happens. I can’t predict the future and don’t know what “is out there on the right-hand side of the chart”. But I know that favourable conditions will likely return at some point, and statistically, I should do well over the next 5 years. So I now think in terms of probabilities. I need to give the system time for the edge to reveal itself over a big enough sample of trades I don’t need to know what is going to happen next to make money in the market.

I trust the story of my journey over the past dozen or so years helps you and other interested readers get through this challenging period in the market.

Regards,

Rob

Hi Ivor,

The journey for trading a mechanical system (especially where you have not created the edge yourself) requires trust and a series of knocks and bruises that will test every sense that you learn in surviving in life. Like downhill skiing, where the safest, most fun and exhilaration, and direct way down the mountain is keeping your body leaning forward and down with your face facing the fall line (directly down) and using your knees and hips to make the movements whilst your upper body is relatively still. Your brain screams and protests what feels counter intuitive and your body aches as it involuntarily turns up the mountain in protest of what cannot be true. The only way to overcome all of this is to keep on trying and believing as you see the most relaxed skiers doing exactly what you fear.

And so it is with share trading. You must believe in the edge as evidenced by longer term traders/investors, however you must also be prepared for transient losses that eventually turn to profits as you continue to trade the longer term.

It easier said than done, but the trust will come with the wins, and the fears will dissipate as time progresses.

As for Self Wealth and those ratings and position comparisons - it is just a load of crock. You don’t know how the information is really derived. A trader that holds one position and luckily has it rocket away using all the available capital means that he/she will be a top trader in the top 1%. Just a lucky punter that usually has their 15 minutes of fame, but tend to disappear with no fanfare. The wealth check seems to relate to whether or not you are fully invested relative to the balance in your ‘no interest’ SWT bank account (you wouldn’t leave money there when near or fully in cash if you can earn interest whilst you wait for the buy signals). The safety rating means zip as it is subjective to criteria that is different to the SWS criteria.

Paper trading may have it’s place for confidence, however the one thing you need to fix is the fear of loss when it happens (intermittently all the time) and paper trading cannot give you that regardless of how much you are theoretically losing. If you want confirmation of the system, just look at the historical results for all the public portfolios.

Good luck in whatever you choose.

Well done all - some quality replies here. Nice post Rob - thanks for sharing! Very helpful to a lot of members I suspect.

Yes, thank you to all for taking the time to contribute such detailed responses. I have found it extremely helpful and reassuring, and I’m very grateful to everyone for sharing. Thanks again.

Thanks everyone for the helpful and detailed feedback. The point made by Phillip “especially where you have not created the edge yourself” is particularly valid with me. Given my current experience using the SPA3 systems I am struggling having faith in the edge. I understand that one needs large numbers to display the edge (as per Mark Douglas’s book) but it has been a very long time since I have had so many loosing trades in a row. I am also struggling with a 20% win rate in a market that is reaching record highs.

Gary I understand what you mean by “but rather from brokers, newsletters, Spotee on Ticker NEWS, mates, family, a forum”. I bought my first share in 1980 and I used those types of sources of info earlier on. I have very little faith in those sources of “information” now. I stopped using that type of information decades ago.

Over the past few years I had been using a buy and hold strategy with buying banking hybrids, indexed etfs( topping up after a market dip) and occasionally buying shares that look good to me such as MSFT, CSL DTL and HSN. Those were bought on the basis of good fundamentals. I have also had some losers (of course). Overall my returns have been reasonable.

My decision to go with SPA3 is that I was hoping the system would give me slightly better returns and more consistent returns with lower drawdowns. I actually believe that the spa3 system generally do have lower drawdowns than the XAO but I am struggling in having faith with the performance so far and its long term CAR (compound annual return). What I am worried about is that the market is behaving extremely oddly at present and I worry that the previously tested edge may not have adapted to todays market. Hence my decision to paper trade for the moment.

Regards

Ivor

Hi Ivor,

Uncertainty defines the market at all times whether it is rising or falling. Using a mechanical, rules based, evidence back system with a clearly defined Edge helps to reduce that uncertainty. However that certainty can only be measured over a large sample of trades, not on a trade by trade basis. I know you understand this.

Our psychological challenge is to continuously have a big picture perspective of the probabilities of our timing system and not be deterred by short term market volatility and medium to even long term drawdown while the market goes through its ups and downs.

The first thing that is challenged is our confidence. As you have stated above. This happens in all walks of life when we get negative feedback from the environment in which we are executing, like a cricketer that has a run of ducks and low scores, or a full forward that misses many set shots over a short period.

When we experience drawdown of any kind we lose confidence and question if we’ll ever come out of drawdown again. There is only one way to rise out of drawdown: keep on executing according to our documented Plan. Failure only happens when you quit altogether.

The Edge has been researched over a wide variety of markets, including rising, sideways and falling markets and all with varying degrees of volatility which create many combinations of market conditions. (You can read the work of Van Tharp on this). The conditions that we are currently experiencing (heightened short term volatility) have occurred many times before and will occur many times again in the future.

Developing Faith will require patience, commitment and being coachable to allow yourself to transform from doubt to belief. It’s what our most successful members have worked on. Some with very similar starting stories to yours.

The best tennis players & golfers in the world all have coaches, meaning that they too are coachable. They are prepared to change the way they currently do things - to improve.

Which means they operate from a paradigm of not knowing better, they suspend judgment and open themselves up to a different way, to potentially become better.

When using SPA3 Investor we always recommend starting with a small portfolio as this helps to minimise the potential emotional swings that you might experience early on in your journey.

If you can keep the emotional swings smaller then progress (skills acquisition) tends to occur more easily as the internal conflicts are also greatly reduced.

Today’s webinar, “Order from Chaos” will help to put some context around this.

Hello fellow SPA3 Investors,

This is my second post to this Forum, as a background I commenced my journey with SWS in December 2020. After initial set up and learning I started my ASX Equal Weighted Stocks portfolio in Feb-21 with a modest amount as a small stepping stone portfolio. This week I completed my first 20 trades, I followed all the SWS rules including documenting a detail Investment Plan and a personalized daily checklist, made a few small errors along the way, mostly due to unfamiliarity with new Saxo brokerage platform and Beyond Chart. Like many people, I am in the third stage of investing lifecycle. BTW, support from SWS team has been very good.

I wanted to share my early experience/observations, now with 20 trades (each documented with reflections and comments) I self-proclaim graduating from L-plate to P-plate! Since I am only in the 7th week of my trading history with this portfolio there is not much to talk about the performance, my ASX portfolio is down 2.8%, with Win-Rate of 28% and Profit-Ratio 1.25%, obviously very early days and hence not relevant at this stage.

I do want thank Nick for sharing his experience and get many people to contributing (IMHO, this is the ‘real value’ of the Forum). My next challenge is to inject additional capital in SPA3 ASX EW portfolio in the form of shares (from the universe of SWS ASX 41 stocks) that I have been holding for years as well as some cash (and managed funds which I would liquidate over time) latter as a funding source is a no-brainer. Any thoughts/insights/guidance on how to bring in currently held shares (from the list of 41) into my SPA3 ASX EW portfolio would be much appreciated.

For those members who have been around for longer than say 3 years, I would be interested to know what would be their net return after recurring costs of brokerage and data feed charges.

Like any new (and experienced) members, I have a legacy portfolio (i.e. Hodge-podge of stocks, ETF and managed funds), I wonder if there is a way to compare their performance in Equity Curve format with SWS SPA3 Investor EW Portfolio and standard benchmark (example $XAO)?

Best regards,

Chandra

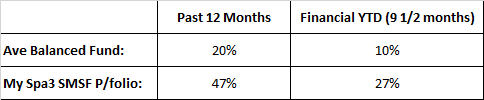

In today’s business sections of the various newspapers, you will see the Superfunds putting on a positive spin on the average Balance funds performance over the past 12 months and also for the financial YTD.

I compared the fund’s recent stated performance with my Spa3 Investor driven SMSF invested in the USA market:

Ave Balance Funds 3 year CAGR : 5.1%

My Spa3 Investor SMSF P/folio 3year CAGR : 12.73%

That says it all.

Yes, the last 12 months have been very rewarding despite recent underperformance due to the choppy ASX sideways action.

My stats for the last 12 months are: 31.9%

Win rate: 44%

Payoff ratio: 2.69

Expectancy: 0.62

Profit factor: 2.11

Max DD: -10.2%

Hope this helps assuage the doubts of recent SPA3 Investors.

Best regards,

Dietmar

Welcome to the Forum. Very impressive.

Hi

I am not a long term user as yet even though I joined in Dec 2019. Had I followed all the market signals I would have put my Industry Super into cash at the time. My problem there was I did not take notice of the system due COVID work and being retired early (Stood Down March 2020) as I was in the International Division of Qantas. So October 2020 I decided to study the system hard and still am.

I wish I had started the system in May as I have looked at the Buy/Sells and my performance would be three times what is is now. So I started October and I am up around 6%. Had I obeyed the rules 100% (I decided not to obey a couple of stops NST COH) I would be 3-4% better off.

Measuring against the ASX over the last 12 months is for me an unusual occurrence in markets as I know of a very good investor who talks publicly, actually two, they went to cash at the bottom and did not go back into cash till late 2020. A huge draw down!

Personally I would not compare the last 12 months, I am giving the System time and I am very pleased with the results since October 2020. I just think you have to ride a few ups and downs and for me that really can be a nervous time as an investor.

So what I am saying is we should not be comparing the Bench Mark over the last year as COVID was a Black Swan Event and we definitely have to give this system I feel 5-10 years. However, for me only starting in October 2020 has proven rewarding. What the benchmark has done I do not care as the bench mark ASX has to be analysed over a long time. I have some money in two fund managers. I put in 2 years ago, they only rose 8% in the last year and in the last 6 weeks back to zero - not good and these particular fundies are purely growth fundies.

Very few fundies beat the index as there are over 2500 stocks - a mine field. These fundies are strictly growth orientated buy and hold and do not take much profit at the top. Industry super funds are similar too but they do a lot better than some fundies. I am also now using SPA-3 Trader this - allows me to pick the stocks across a large range, however it is at High Market Risk I cannot buy using Risk Profile 1.

For anyone who is struggling with faith in the system early on, maybe create a satellite portfolio, wait for a pullback and start again but keep the other portfolio running. I will create a few satellite portfolio’s. I have 10 stocks now that might be another option for any of you. This is not financial advice just what comes from reading SPA 3 Investor course.

Hi all, fantastic thread! I too am new to spa3 investor having made my first trades just a few weeks ago. I too am in drawdown on my base capital. However I am a strong believer in the mechanical approach and I will persevere over the long term (at least i am yet to hit my comfort zone limit on drawdown and I have committed to myself that I will stick with it!)

However I do note Ivors comments and wonder about the spa3 investor edge going forward under future untested market conditions. My thought is that perhaps broad global market influences may over time erode performance of any system and perhaps there is a case to recalibrate the system or even consider alternative systems over time. I’m sure some systems worked better in the 1980s than they do now for example. And then if that’s true, how do you measure performance of a system and know when it’s time to recalibrate or shift to a different one? My comments here really relate to any mechanic system, not this one specifically.

Am i off the mark? What are people’s views on this?