My views only, fwiw:

Systems work till they don’t. SPA has been around a long time and does get tweaked over time. You only know when something breaks after the event. The system still has the edge and it still works well as designed. Of course every portfolio is different in the short term but as time passes the defined and researched edge becomes closer for all portfolios.

This is purely a mechanical system based on a researched and defined edge that can be validated by the public portfolios. It is irrelevant what thoughts you or I have about global events etc. In fact when you hear yourself, with respect to the share market and a mechanical system, saying ‘I think’ stop and realise that acting on those thoughts will change the edge of the mechanical system - usually to its detriment.

Great advice, thanks Phillip. Particularly useful to know that SPA does get tweaked over time. For now I will trust the experts at share wealth to ensure that occurs as necessary.

Cheers to keeping ‘I think’ out of the vocabulary.

Thought I would revisit this thread.

Obviously performance has dropped with the bear market but are the transaction (trade) numbers up heaps too? I have counted 48 trades (round trip) so far this calendar year. I remember a presentation from 2019 ( I think) where a 9 position portfolio would only have circa 19 trades per annum. Other metrics were Exposure 84% DD 15.3% and CAGR of 20.3% although these backtested results would be prior to the 2022 tweaks of course. Cheers

Nick, cleaning up emails and noticed this Forum post.

These are all changing metrics to analyse the ‘engine’ of a portfolio.

ASX Public Portfolio has completed 43 trades (closed) this calendar year, with 9 currently open = 52. This is high. In the previous 7 years the portfolio has averaged 34 closed trades.

A separate personal SPA3 Investor portfolio has completed 22 trades this year. It trades with 7 simultaneously open positions.

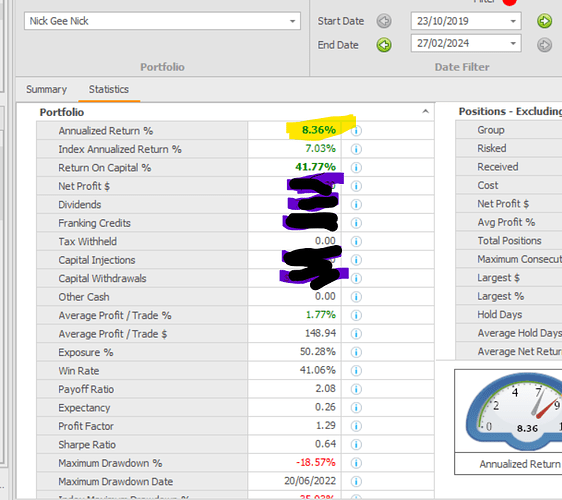

Updated returns after 4.5 years which is probably long enough to assess a system. Just posing the question to the forum. Is this really a good enough reward for the effort?

The positive is certainly a reduced drawdown vs the index buy and hold - but returns are mediocre IMO and once you take tax out along with slippage, it’s all pretty marginal. There is also plenty of specific stock risk especially during earnings season.

The number of transactions are way higher too along with a winrate lower than the backtest.

Just to clarify, I execute flawlessly - not always at the close - but always during the correct session.

As always I am interested in others’ thoughts but I just don’t seem to be getting anywhere - I thought I would have by now.

This is not a dig at the business itself - they are clearly motivated to help you succeed and the service is great but is there enough alpha to justify the whole exercise?

Happy to stick with it for now as I have been through the pain but it’s worth asking the question IMO.

G’day Nick,

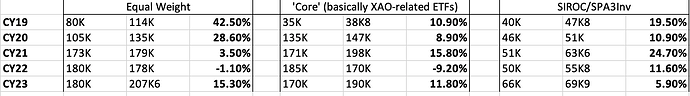

Without making any analyses or comparisons, I have summarized below my gross results, year-by-year, since CY19 (Hopefully my screenshot is readable after I post it!). My overall SMSF is divided into components, a couple of which have not been maintained over the 5 years. Of the three which have remained, one is ‘Equal Weight’, basically following the daily buy/sell triggers; another is like a ‘Core’ component, essentially holding EFTs connected to the XAO; the third is a smaller component with investment selections based on either the SPA3 Investor triggers, or an analysis of SIROC charts (essentially, ‘buy’ when a stock’s SIROC crosses above 30, and ‘sell’ when it turns below 70).

The EW component contains about 6 holdings and the smaller SIROC contains about 3 holdings.

Partly because my SMSF pays pensions to members each year, and partly because the number of ‘components’ into which my fund’s assets are divided each year changes occasionally, the value of each component of my SMSF at the beginning of a year needs to be adjusted. Hence there isn’t a continuous, untouched value associated with each pf those components. Accordingly, I have provided below the year-start and year-end figures for each component to show the gross start and finish asset values for each component for each CY since 2019.

Probably the main components of interest will be the EW and, to a lesser extent, the SIROC/SPA3Inv. During the CY19 to CY23 period, I have followed the SPA3 Inv triggers closely, although I couldn’t promise that they have been followed literally to the letter, so to speak. Where they occur, variations from the ‘strict application of the rules’ have only been minor.

Regards

Paul

Hi Nick,

Thanks for the post. It’s a great opportunity for the community to discuss financial performance. Just as it is to discuss skills performance.

My first observation is that your portfolio exposure is only 50.28% which is well below the SWS ASX Equal weighted public portfolios exposure of 88.7%, some 76% below what it should have been over the same time frame.

This would suggest either not taking some trades when the portfolio had vacancies, or more likely your positions being too small for the amount of capital you injected into your portfolio.

This can make a significant difference and would have added return to your overall portfolio purely because the portfolio was profitable - you would have done the same trades and overall, they would have returned more absolute profits.

Given the above, the 41.77% performance of your portfolio compares favourably against Hostplus Balanced (34.6%), Shares Plus (39.9%) and Australian All Shares (39%) over the same time frame, 23rd October 2019 to February 27th 2024

The portfolio again compares favourably against Stockspot’s Balanced mix (25%) and Aggressive mix (31%) and also significantly outperforms the Montgomery fund (24.7%) and Montgomery private fund (18.7%) to the end of January 2024.

Drawdown or Sequence of Returns Risk is the number one risk facing Stage 2 & 3 Investors, those nearing or already in retirement. Avoiding large drawdown during these periods is essential.

At some stage in the future, we will again likely have another 50%+ bear market and that’s the danger of not using a mechanical, no wiggle room methodology. Eg, Buy and hold of stocks or ETF’s.

In terms of effort, the SPA3 Investor process shouldn’t be taking any more than 15-30 mins (max) a week.

If it’s taking any more time than this then the question is why? Are you doing “research” or extra “analysis” which is not part of the SPA3 Investor process?

Investing is a skills acquisition process and the acquiring of and fine tuning of the skills is an “infinite game”. It never ends. The skilling is an ongoing process entailing the creation of new habits and beliefs which are essential to playing the “infinite” game.

Members that have completed the 4 Week Process & Mindset Intensive are asked to complete a Skills Acquisition Plan (SAP). The SAP includes a section on Reward Objectives and how to determine whether a portfolio is on track. I have included this section below.

Reward Objectives:

The Mission for this portfolio is to create new habits, energise new beliefs and de-energise dysfunctional beliefs with respect to active investing.

However, the mechanical methodology that will be used in this Skills Acquisition Plan has a well-researched Edge which has been demonstrated in live trading with real-money on the ASX and USA stock markets.

So, while executing this SAP Portfolio there will be a Reward Goal:

The aim is to grow the funds allocated to this portfolio by 4% annualized more than the ASX 200 Accumulation Index.

To determine whether the portfolio is on track to achieve this aim, the annualized return is to be measured whenever the portfolio reaches a new all-time high portfolio value.

The annualized growth will be compared to the annualized growth of the ASX200 Accumulation Index to determine the relative growth of the overall market and whether the Portfolio is on track or not using SPA3 Investor’s current rules.

The time to assess the reward objective is when your portfolio has reached a new all time high. Currently the SWS ASX Equal Weighted public portfolio remains in drawdown, by -5.67% but is in a strong run up phase. Once the portfolio reaches a new all-time high, we’ll be able to assess performance against the reward objective.

You can download the Skills Acquisition Plan here.

All good Dave - I added funds to the strategy so that may explain the exposure - I have been taking all trades as per signals.

I have been using SPA investor for about 5 years with about 45% of funds in the ASX and about 55% in the USA market, both NYSX and NASDAQ. AS I am on a pension, I rely on my investment for funds to live, so I extract about 10% of my capital each year for living a better life than the pension provides. I have averaged just over 17% p.a. for the 5 years and have usually followed signals as they come. I do use a little judgement, such as ignoring BAP signals which I regard as stocks on the way down. I also look at the charts when buying if there are no obvious buys, choose high ranked shares which have a fairly even past upward movement even if the buy signal on them was up to about a month ago.

I am not suggesting that others follow my variations, as the system works well, but I am happy to tinker with buys slightly, although I never ignore a sell signal.

Hi Nick.

Just a thought, I have 2 portfolios, one of which I withdraw from and add capital to. The other portfolio is stable, no injections or withdrawals. I have found the stable portfolio shows better performance (albeit over a shorter timeframe). I think when you are other injecting or withdrawing capital it can impact the results. For example if you withdraw capital at the start of an uptick. Also if you inject capital it can mean a higher than expected proportion in cash for a while.

Trish

Hi Nick,

I wouldn’t categorize myself as a model SWS client as I’ve variously missed/ignored signals over the past few years as I was working full time up to 2022 and to be honest a lot of the time I was avoiding the trading system. However, with all that I did an analysis on my trades over the same period as Nick (ie 23/10/19-27/2/24 and my portfolio achieved an overall 49% gain at about an 8.3% compound return. I have in the past struggled with my inconsistencies in adhering to the SPA3 Investor signals (I always take sells but sometimes didn’t take buys because of my personal view about them and, worst of all would take myself out of trading for a period after a big loss🤦♀️) Having said that I am extremely grateful for the 4 week Process & Mindset Intensive Course, which popped up last year which, true to form, took me about 8 weeks to complete. Nick I completely get your concerns, we are working on our financial futures here so it is a serious game. The only thing I can offer you at this point is one of the big things I got from the 4 week intensive is that if you accept that the system you are working has an edge (which I do) then like the casinos it is vital to be in every trade exactly as proscribed because methodologies with an edge only work over an extended period by participating in every event. Since Xmas I have worked at working at the system including listening to the weekly wraps and the bi-weekly Connect & Grow seminars ( Confession- haven’t listened to this weeks yet but on my list for tomorrow).

If you haven’t done the 4 Week Intensive do yourselves a favour, (even if McCulloch and Stone do drone on a bit LOL) it’s worth it in the end

Cheers

Barry

Hi Barry,

We make no apologies for all the repetition in the 4-Week TI. ![]()

Sounds like it worked to some degree… ![]()

Thank you for your words of support. But more importantly, thank you for putting your precious time into completing the Intensive and allowing us to be on your computer screen with the training.

Gary

Haha yes I agree Gary it does take repetition to really get the concepts anchored in place. Thanks again for the 4 week TI it has made a big difference

Cheers

Barry

Thanks everyone - good discussion - the comments from Patricia are insightful as I think it’s affected the Exposure metric. And possibly the CAGR - not sure.

Just for clarification I have never thought this system didn’t have an edge - it’s just the effort commensurate with achieving that edge that so far has been pretty marginal. And that’s before tax.

I suppose for some added context, when I embarked on researching the strategy and the characteristics important to me, the features that stood out were (as at February 2019 backtest):

For an 8 stock portfolio (of a then 30 stock universe) the metrics backtested at 21.3% CAGR / Max drawdown of 15% and 16 trades per year. Now I note that the Reward objective has been revised down but at the time this was the information I was working on.

Now the actual result is circa CAGR of 8.5% / Max DD of 18.5% (in line) but the trades are averaging 34 per year which is more than double the expected. I actually have 297 trade records since October 2019 at $9.9 a trade so there is significant commission drag as well. With more trades comes more friction / slippage / psychological challenges. Just this week I have experienced around 0.7% of slippage with the BSL and FLT trades. Now slippage can also be positive from time to time but the additional workload of all the trading activity introduces these possibilities in the first place.

So my point is I am expected to work on my psychology to deal with a system that hasn’t matched the label on the box. Once again these are just the uncertainties of the markets and 2022 was pretty rough but I still think I have valid points. And I don’t discount the level of work that goes into the research but this forum topic is mainly from an end user point of view.

Don’t get me wrong working on our psychology is always a good thing and can assist with the acceptance of ‘anything can happen’ but I don’t know what more I can do process wise apart from exclusively trying to trade as close to 4.00pm as possible.

As mentioned in my previous comment, I will continue to push through as I am sure it can make gains very quickly at times and move closer to the reward margin which the public portfolio is currently at. But it’s transacting far more frequently than I want it to.

But raising these points is why we have a forum isn’t it? ![]()

Have a great weekend all.

I agree with Nick. I’ve been using this system for 18 months now, and doing it mechanically as instructed to. With dividends included I am breaking even at the moment. Much more trading required than advertised, and also more than the15 minutes per week advertised. I use another algorithm service called motion trader that has much wider stop losses, and it is a lot more profitable, with less trades. I will continue using SWS and hopefully the returns improve significantly in the future. As of yet, motion trader is winning, but time will tell.

Great to see people discussing their views honestly. I think we can all relate to how people feel.

I have a great deal of respect for SWS and the team, and have learned a lot.

One key lesson is to set entry and exit rules before entering the market. I have taken this and applied it to SWS as a whole.

I’ve entered the system with a five year time frame as it’s been explained that the system needs enough trades for the edge to emerge.

If after 5 years my portfolio is not performing as expected (5% over asx200 and same or less drawdown) then I’ll give it 12 more months to get a second 5 year data point. If it is still not performing it’ll trigger my exit rule and I’ll exit the system (which will bring me no joy but it’s not about emotion).

Interested in how other people are thinking about Nick’s post.

I am very grateful to Nick for raising the topic and getting us to challenge and assess our portfolios. Using SWS gave me the confidence to move away from a financial advisor and that in itself has been a huge saving - and something I am extremely grateful for. I started trading a bit later than Nick, but I think we have both been impacted by a market that was rather erratic for quite an extended period- and during that time we were taking the BAP signals (which certainly in retrospect damaged my returns). I have seen marked improvements since the amendments to stop using BAPS, the market has also started trending better so things are looking more positive for me. I have done the intensive course - but I have been executing mechanically from the outset so apart from some reinforcement it didnt change my process. As a note I use market on close orders on Saxo which makes it easier as i don’t need to be around trying to trade close to 4pm.

I agree with David, assess after two 5-year periods and then make decisions if required.

Thank you for the topic and have a good weekend

P

Hi all

I have been trading the SPA3 Investor system since Jan 2021 with 5 stocks. I have slightly underperformed the public portfolio return of 3.3%CAGR with only one trading error exiting Whitehaven coal- guess what it was a large profit trade foregone. The index return for this period has been 8.9% so over time with the edge should be approx. 13-14%.

100k invested will be $110k (approx.) with the public portfolio, index $129k and add in SWS outperformance $144k.

Prior to joining SWS I was with another trading company for 7 years who were very experienced traders with a high level of integrity and have been around for a long time. The program did not have a publicly traded portfolio or the same level of commitment to the teachings of Mark Douglas- underperformance again for my trading/investing. I have been at this trading game for 10 years – the opportunity cost v just investing in a high growth super fund is several hundred thousand difference.

So I have a few options:

- Give up, look for another trading system – this will take me on a journey of spending my life searching and exploring systems.

- Transfer my SMSF funds to high growth super and subject myself to a large drawdown life GFC /Covid. I vowed after the Covid crash to never experience a major drawdown again.

- Continue to keep doing the same ie Trading like a mechanical pro- in the words of Mark D you see the signal, you act without fear/hesitation and completely accept the randomness each trades outcomes. This is always what I desired…the money will flow……

Today the All Ords hit 8000 for the first time. This year could be another 2019 for the public portfolio: 59% followed by 2020 24%.- a couple of great years. Could this year be like that: I don’t know and neither does anybody else. What I do know is if I miss this I will forgo the opportunity of $ flowing into my account.

NICK,

The CAGR is correct regardless of how much you inject or withdraw. This has been implemented in the PM for a most of its life.

Straight after your first comment I asked Karl to check with the devs if the Exposure calculation accounts for injections and withdrawals. I’ll let Karl provide an update on that here on the Forum.

Nick,

Good point. As you know I make quite a big point about effort to return ratio.

Let’s have an open discussion about this as I shouldn’t assume that everybody follows the exact same daily process as I do.

I run 4x 100% SPA3 Investor portfolios. My SPA3 Investor trading process REALLY does take me around 15 mins a week, on average, to manage all 4 portfolios. Definitely less than 30 minutes a week. Even with the high number of trades that have been done over the two years - I’ll comment on the high number of trades in a separate Post.

Here’s my process:

Every day I check the App. Using the App is key for my efficiency. If there are no Sells for my portfolios (which come up red under the Portfolios section of the App), I do NOTHING. I don’t even have to open Beyond Charts.

To check all 4 of my portfolios for a Sell takes about 1 minute to open the App and open all 4 portfolios.

This daily process can last for 2 - 3 weeks, even longer with my record being around 10 weeks w/o needing to do a trade - basically 10 minutes over 10 weeks.

If there is a Sell signal, I place a MoC order on Saxo for ASX and for US. 3x portfolios are managed on the Saxo platform. One is managed on Self Wealth.

To place a MoC Sell order takes around 3 minutes including opening up the Saxo platform. Additional orders on the same day take around an extra minute each.

If there is a Buy signal and I have available cash in any of the portfolios, I do the Buy transaction in the Portfolio Manager to calculate the Qty of shares to buy, Save the transaction is PM, then enter the trade for that Qty on Saxo with a MoC order. After the order is filled, I edit the PM entry with the filled price and correct brokerage.

For the first order on any given day it’ll take me around 3-4 minutes to do this. And additional orders on the same day, around 2 minutes extra for each.

With Self Wealth, I do most of my trades around 11am with a limit order at the current market. I do no finessing whatsoever. Most orders go through straight away.

I then print the transaction note, and file it.

I enter Dividends in the PM whenever they are paid.

Most days after the market close, or the following morning, I’ll look at the 4x portfolio equity curves in Beyond Charts PM.

Fortnightly, when I’m preparing for a What’s Up With The Markets C&G Market Status, I’ll have a quick look at various portfolio stats.

I’ll also do some portfolio analysis when we have questions from customers. Directly in calls, or for a Forum discussion like this. And which I have spent around 20 minutes doing today having read through the points raised. More in a separate Post.

I’ve painted this picture to assist those who may do additional reading or analysis for some or all signals. It’s your choice to do that but you shouldn’t count that as SPA3 Investor process time. That’s what subjective traders do so count that as time & effort that you would do if SPA3 Investor was not being used to manage a portfolio. Most people who do additional analysis do it as part of their relationship with the market or for additional learning purposes. That’s fine. But it shouldn’t be part of any mechanical trading process.

Key for me to be efficient is using the SWS App and the Portfolio Manager integrated into Beyond Charts.

I haven’t run a SPA3 Investor Scan in Beyond Charts since a few months after we released the SWS App for few years ago. Nor have I stepped down through stock charts in the Watchlists since then, as I used to do to manage my portfolios.

Once spreadsheets are used for portfolio management, and doing additional analysis in BC, reading reports or searching social media for input on buy/sell decisions etc comes into the picture, time & effort skyrocket. As does indecision, confusion etc, which also skyrockets time & effort.

All this is valid for subjective trading, but not for mechanical trading. We developed the tools to make the process highly efficient.

What do others do as part of their regular trading process for SPA3 Investor?