Most will now be aware that a Corporate Action has been applied to the WOW share price in Beyond Charts. The Corporate Action is applied via what is called a Dilution Factor. This can either be a ‘stock split’ (all historical prices are factored lower) or a ‘stock consolidation’ (all historical prices are factored higher). You can see all these splits and consolidations for every stock under Corporate Actions in Beyond Charts.

The result of the Corporate Action being applied to WOW is that the Sell Signal that showed for WOW is no longer present. Meaning that, according to SPA3 Investor, WOW remains an open trade.

Firstly, how could this happen?

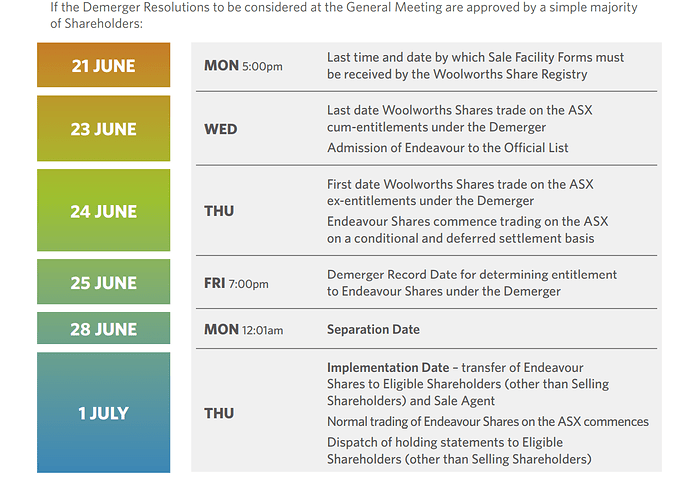

I had a long discussion with our data provider about the implications of applying this Dilution Factor to the Thursday 24th June ‘final’ data on the morning of Friday 25th June, i.e. changing the data after the fact, rather than applying it to the following trading days ‘final’ data, i.e. Friday evening at 7.30pm.

The bottom line is that the timing of publishing Dilution Factors for all Corporate Actions from the relevant stock exchange authorities over the years has been, and continues to be, inconsistent. Hence the policy adopted by our data provider is to apply them to their data download as soon as they are known.

In nearly all cases, SWS and our members do not notice this ongoing data cleansing and management process happening in the background. (In the ‘old days’ most data providers didn’t adjust for splits and consolidations, investors had to do it themselves! Some still don’t do this well enough!)

The WOW scenario obviously has been noticed.

Importantly, applying a Dilution Factor is the right thing to do for correctly charting WOW going forward, because WOW became roughly 11% less of the business it was before the spin-off. So it had to be done.

The next question was WHEN to apply the Dilution Factor. Ideally as soon as WOW started trading ex-EDV, i.e. on Thursday 24th June. In this scenario that didn’t happen as the Dilution Factor hadn’t been provided, probably not yet calculated either by the ASX because EDV hadn’t started trading.

Alternatively IMHO (and our data provider’s), WOW should have had a Trading Halt and/or EDV traded on a Deferred Settlement (as EDVDA) as has happened over the years with so many other similar situations.

If the Dilution Factor had been applied on Thursday 24th June at 7.30 pm then there would NOT have been a Sell signal.

But that did not happen so we now have a situation where some have sold WOW and others haven’t.

What action to take…

It is now clear that if you sold WOW today you will get an allocation of EDV. Some appear to already have an EDV Sell Price from their broker, others may have to wait to see what that Sell Price is to enter into your Portfolio Manager.

Following your Investment Plan you should have taken a new position in a different stock today, so your capital should be the market, just in different stock. And potentially in a smaller position size (if you didn’t have any other available cash in the portfolio) as the EDV portion won’t settle until next week.

For those that did not Sell, because they are waiting to be able to sell their allocation of EDV on their broker platform (like SAXO), you now have updated data which is deemed to be correct.

So Sell or Hold?

SWS cannot definitively provide advice as to which you do, except to say follow your Investment Plan.

In following the Investment Plan for the ASX Public Portfolio, having not sold for the reasons stated on this Forum earlier today, we have to continue to HOLD WOW, because the new data shows NO Sell signal.

Having sold and re-entered a different stock, or holding WOW based on updated data, are not ‘trading errors’ according your Investment Plan.

We can only act on the data we have at the time. And for the sake of the timing of the recording of the price data for this change in WOW’s business, both data sets were correct at their respective times. This happens in the real world.

Learning from this scenario

We must continue to maintain Investment Plans that can handle just about every type of market scenario so we can easily and efficiently determine what objective action we take in the heat of the moment when it arrives.

SWS will update the SPA3 Investor ASX Public Portfolio Investment Plan to include clauses for Takeovers and for Corporate Actions.

I trust that this clarifies this unusual scenario.

Best Regards

Gary