Nick et al,

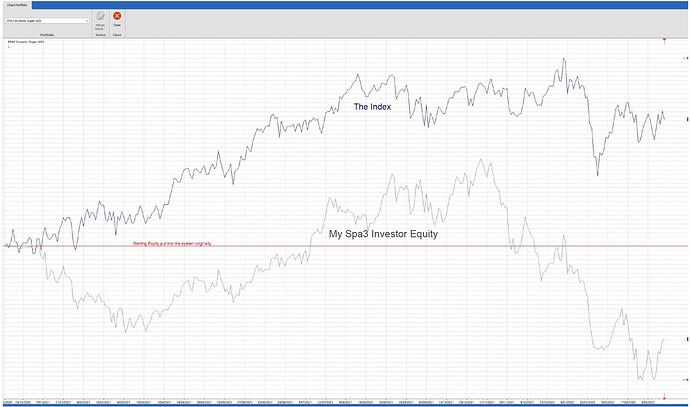

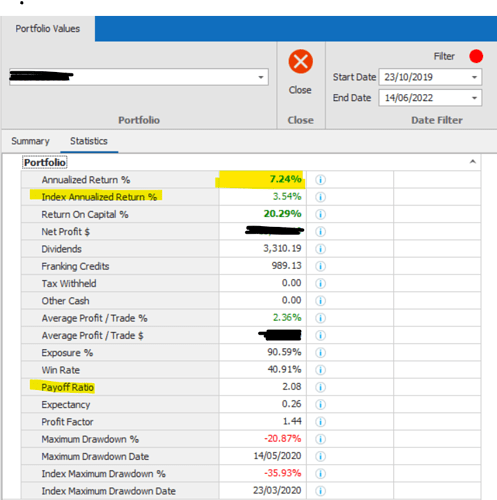

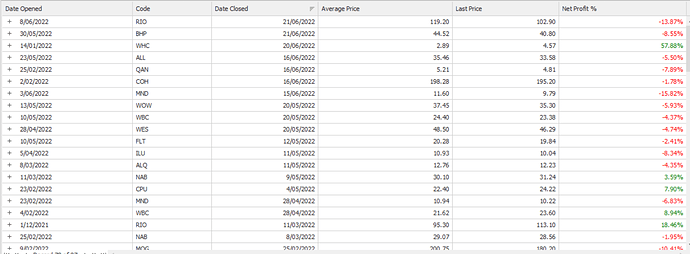

As mentioned in the Supplementary C&G last Fri, SWS has indeed been deep in research for a few weeks now to mitigate the drawdown that is occurring with SPA3 Investor portfolios, especially with US portfolios.

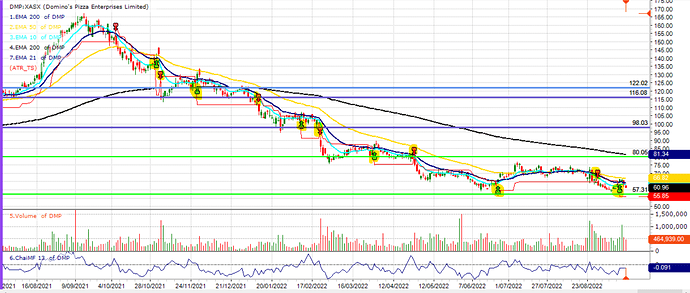

As is well-known, trend-following systems struggle the most in long-lasting sideways and slow-falling markets. As has occurred for 13 months now on the ASX and 11 months on the US markets.

Long, slow, deeper (>20%) falling markets are fairly rare (haven’t had a similar market to this since 1989-1990 and 2000-2002 in the US - 2008 was 2 sharp falls) and, as such, presents a brilliant dataset to research how to best handle them with the current universe of stocks, in preparation for the next occurrence. Which may or may not be sooner than the gap between the last occurrence and this one…

Research avenues that SWS is working on with SPA3 Investor:

- Risk Management: revising Market Risk variables to use longer term Index timing that is better suited to a longer-term system such as SPA3 Investor.

- Money Management (Position Sizing): incorporating %Risk (same as SPA3 Trader) position sizing alongside Equal Weighted.

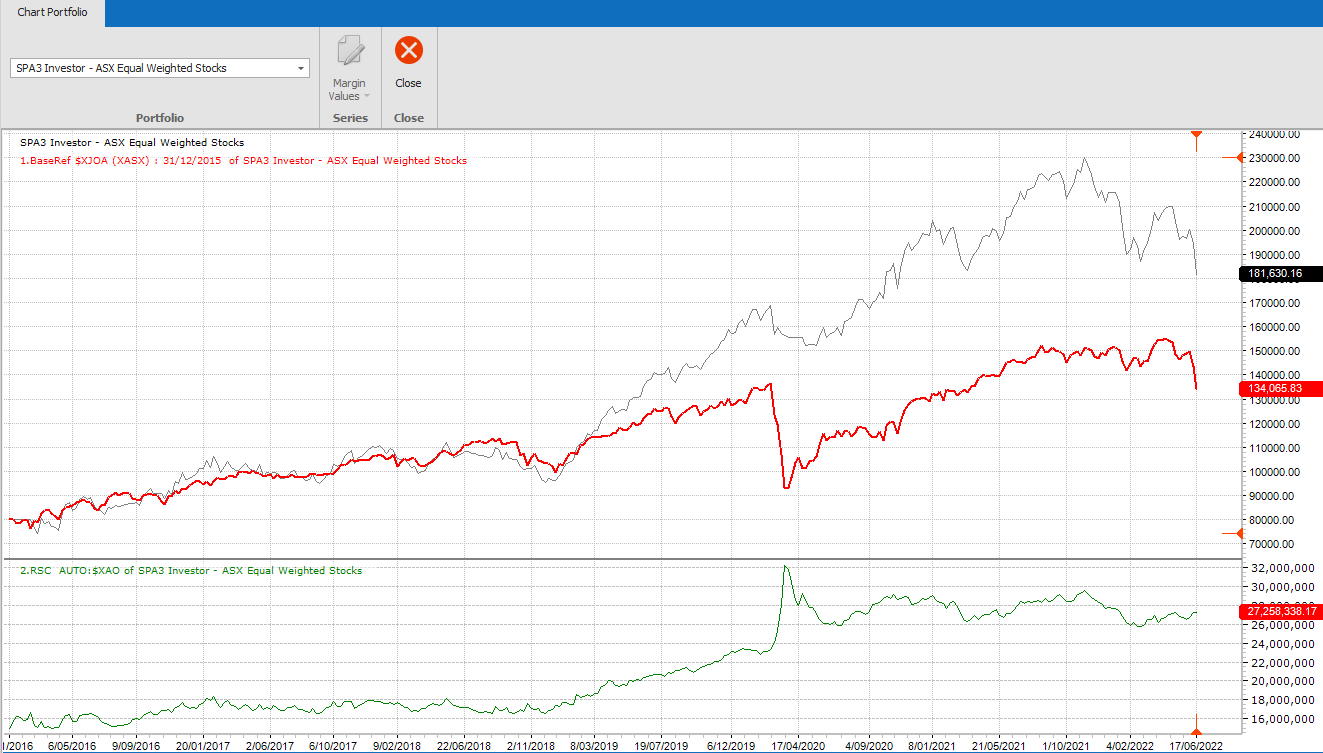

- Method: adding a Filter to individual stock timing (e.g. SPA3 Trader uses RSC - Relative Strength Comparison).

Risk Management: a new set of variables has been researched to determine Market Risk timing. Early results are promising to determine when to use BAPs and when not to, and when to reduce exposure by reducing the # of open positions.

Method: Various filters have been and are being researched, including RSC, various Moving Averages and other concepts.

Researching price action in the financial markets is a tough gig. What seems to work over a short period of time over a small sample rarely works as well across multiple market conditions over a longer period and larger sample of trades.

For a good explanation of researching, please read page 152 of my short-book “15% Per Year in 15 Minutes Per Week” and the 1 or 2 pages leading into it. The short-book is available in the Education Centre to all members in the SPA3 Investor and SPA3 Trader courses.

Reducing drawdown with SPA3 Investor on the US and ASX markets is the most important and urgent project in SWS at the moment and has my full-time attention. However, we are are mindful not to stifle returns in the process.

There are already improvements that we have identified but would prefer to complete researching a few more concepts that we have on the list. Whilst research is always “how long is a piece of string”, we are fully aware of how important it is to make the most of this fairly rare period of market conditions and to implement the necessary modifications to the methodology, which we are fully aware is a “big thing”.

Whilst Wealth Lab is used for most of the research, concepts that work well-enough (it’s nearly always degrees of… and seldom absolute) will be added to The Simulator in Beyond Charts.

When we get there, I will present the outcomes in a special Connect & Grow Webinar.