Ivor,

Have you listened to the C&G session that I presented last Wed? What I’m about to say will make far more sense to you if you have. And if you have and what I’m about to say still doesn’t make sense, then listen to it again.

I’m not suggesting either of the 2 possibilities you have stated.

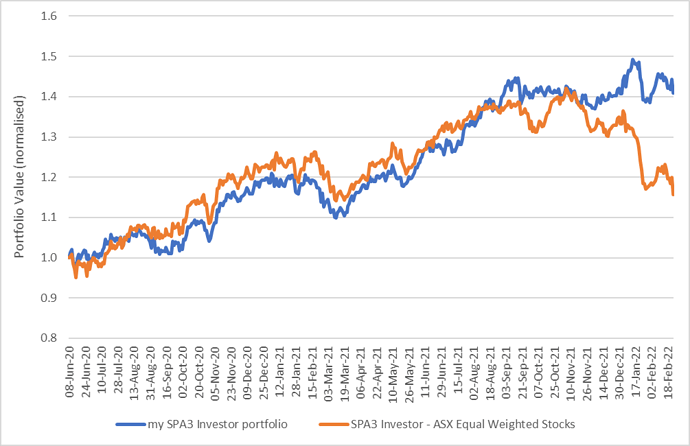

What I am suggesting is that there are many many others who are also experiencing similar %age drawdown to what you are, some a little less and others even more. Indeed, I am one of those in one of the US Public Portfolios.

However, their (and my) feelings are very different to yours. That is, their truth (and mine) is different to your truth. Not wrt to the %age drawdown, but wrt the way that they are framing and positioning this drawdown in their minds compared to how you are.

To repeat, same / similar performance over the last 15 months, different feelings and mindset.

WHY is that ? Because they have a different perspective and understanding that isn’t ONLY determined by the last 15 months (actually about 4.5 to 5 months of the last 15 months).

They have either experienced or sought other input and evidence to help them frame the performance from the last 4.5 to 5 months (ASX) in a way that best positions them for their best execution in the future.

Do you really think that in nearly 27 years of business you are the ONLY SWS customer who has experienced what you are experiencing right now?

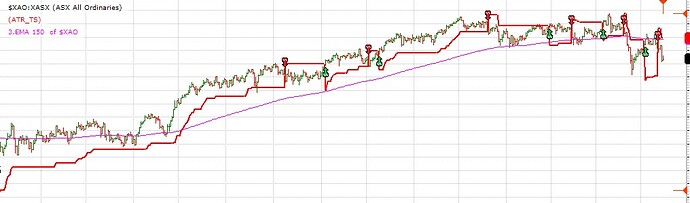

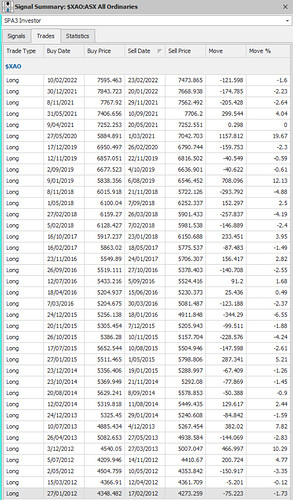

It has happened so many times since we released our first mechanical system in Oct 1998 and then started publishing the SPA3 Trader equity curve back in 2001, just over 21 years ago! .

Similar words to yours have been written on our Forums in 1998, 2000-2002, 2006, 2007, 2008, 2010 -2012, 2014/15, 2018 and now in 2022. Basically every market hiccup of more than a few %. And the SWS team has fielded direct questions such as yours via email and phone.

EVERY TIME others have felt what you are feeling now, the mechanical system equity curves have gone on to achieve new all-time highs in their portfolio values.

We’ve just never known WHEN the new all-time highs will occur. But occur they have.

One thing is for sure, a new all-time portfolio value high can ONLY occur for those who stay the journey.

Years later, some are still experiencing what you are now. They are the ones that stopped executing. Which has probably left their portfolio values in drawdown forever…

I can’t guarantee when another new all-time equity peak will occur in the public portfolios, or even that they will occur at all.

All I can do is keep executing to allow the Edge to play out in the market and to ensure that my mindset is in the best possible place to do that. A bit like life.

With regards to other investors if they have benefited from past out-performance it is a lot easier to return some profits during a drawdown.

This point has been much debated by existing customers over the years. Indeed, many have concluded that having a drawdown in portfolio value BEFORE a runup is the better order (not necessarily the easier) from which to learn, than the other way around. As with any sample, that is NOT a 100% agreed upon point, but it does show that the point you trying to make is not necessarily the truth for everybody.

Anyway Ivor, all myself and my team can do is try to help you achieve a similar investing perspective that we have helped others achieve over the years - one that works wrt to investing; or that others have helped themselves achieve on their own through the use of a mechanical investing system.

It certainly is not my intention to make you feel worse from posting my comments here, or in the C&Gs that I present. Merely to provide an insight that is different to what yours is at the moment. Hopefully one that helps you improve as an investor to achieve the success that so many others have over the big picture long term.

Regards

Gary