Am I the only one who since joining has seen a 20% decrease in my portfolio? Seems to many closes at a loss and none at a profit. With the sales pitch saying 15-20% returns per annum I have a long way to go to recover…

Andrew,it is difficult to remain positive when you get a run of losses

However it will end and then a run of winners is likely

That is what I have seen over the last 6 years following the system, both here and in the US

It’s a cycle, we’re just in a particular part of the cycle at this time

The important thing is to keep executing and stick to the rules

With the recent run of losses my portfolios have just dropped under 20%pa profit

All the best!

This morning I read that the benchmark return for 2021 was 31%.

I think investor got around 15%.

Therefore, if you can mix it up with a few discretionary winning trades you can get a good return.

Hi Andrew,

It looks as though you started in October 2021, 3 months ago. It is not uncommon that after starting that you will enter a period of drawdown simply because losses are cut short when trend fail to eventuate.

On the flip side of this your best trades are going to take the longest amount of time as the trailing stop “follows” trends higher until an eventual retracement occurs and an exit signal results.

If you are using the Portfolio Manager in Beyond Charts we can easily take a look at your portfolio to see if there have been any execution errors that may have added to the current drawdown. (For example not evenly weighting each holding)

We are currently working on an inbuilt resource which will be part of SPA3 Investor that will allow you to check how well you are actually following the SPA3 Investor rules.

You’ll be able to set a start date, amount of positions and capital and “run” the portfolio from that date. The results should match yours over the same time frame if you’ve followed the rules with consistency and discipline.

In a small sample size of trades there can be a wide variation of results, but as your sample size increases the prevalence of the Edge becomes much more evident.

This is one of the reasons for running the public portfolios, to show how a portfolio behaves during different market conditions.

Having said that, there were definitely some periods during 2021 when starting a portfolio would have been challenging because of choppy sideways price action leading to a number of short-lived trades.

It’s a major reason why we advocate starting with a small amount of capital and allowing yourself time to develop the necessary skills to be able to execute without fear or hesitation in any market.

SPA3 Investor requires a long term outlook with a minimum of 3 years but preferably a 5 year time horizon against which we measure a rolling average return. We look to outperform the Benchmark by between 2-4% p.a over that time frame.

Gary did a great webinar on how this pans out over the longer term, in November of last year. Here’s a link to the recording in case you missed it.

https://learn.sharewealthsystems.com/courses/249702/lectures/36380481

Regards,

David.

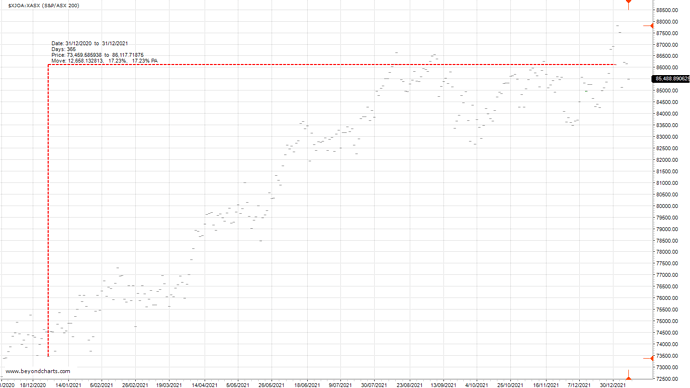

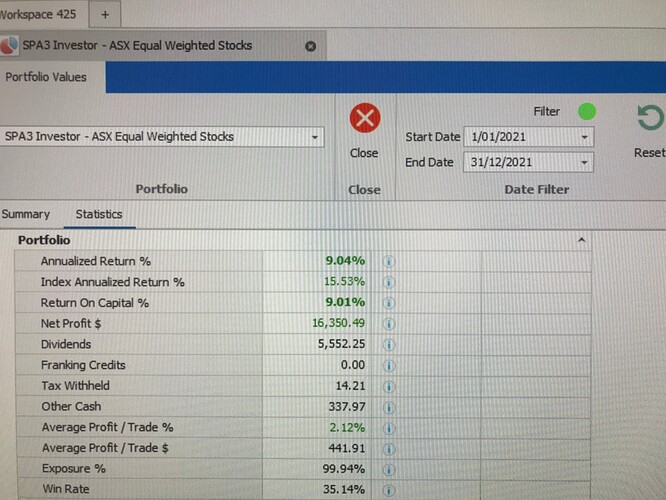

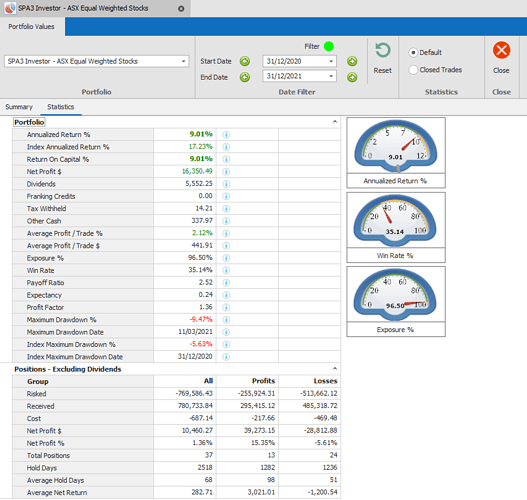

Jermayne, the SPA3 Investor Benchmark ($XJOA) the ASX200 Accumulation Index returned 17.23% for the 2021 Calendar year.

Remember that SPA3 Investor uses a purely mechanical, non discretionary, 100% objective decision making process. It can be repeated using the same steps each and every time.

David.

Agree David.

What I was trying to say is that, if you run a mechanical system and then separately (another satellite) have a discretionary trade or two one can achieve a decent return perhaps close to other benchmarks.

I have no idea how 31% was gained. The return without dividends was 13% for 2021. I suppose with dividends it would have come up to 31%.

Jermayne,

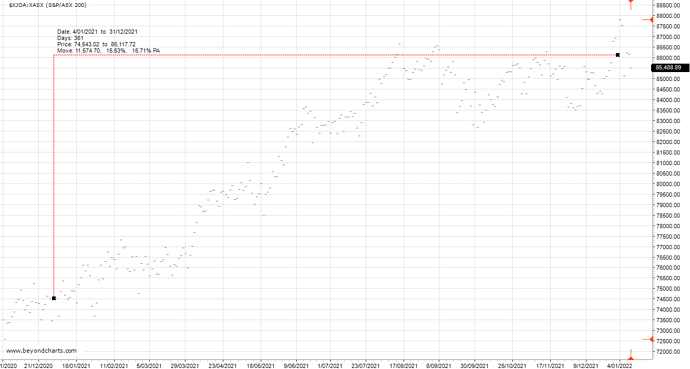

You want to be measuring from the OPEN of the 1st Jan 2021 - so should be entering 31/12/2020 as your start date.

Thanks Karl.

Why does that make such a big difference especially, when the market is not open on the 1st or the 2nd of January?

Due to the 1/1/2021 being a Public Holiday, the date filter will default to the NEXT available trading day, being the 4/1/2021. Also seeing as the 4th was a 1.47% up day - the calcs are correct as you can see by the chart below:

Got it… Many Thanks Karl