Transforming into a successful rules based investor requires 3 essential inputs.

The first is the use of a methodology (system) with a known and proven Edge. This needs to be supported with sound money management, input number two.

And most importantly the third, is the acquisition of the necessary mindset to execute the system over a sufficiently large enough sample of trades…think multiple hundreds in order to see the Edge manifest. This is one of the main objectives in running open book public portfolios.

The number 1 challenge for most investors is that of handling drawdown. For most it equates to pain, not physical pain but emotional pain. And it’s our inbuilt ancestral pain-avoidance mechanisms that create the biggest hurdles to overcome. This requires some work, but is absolutely possible.

James Clear makes a couple of succinct points in Atomic Habits.

The process of behavior change always starts with awareness. You need to be aware of your habits before you can change them.

The 25 trades exercise in the 4 Week Process & Mindset Intensive is aimed directly at this concept…raising awareness of your current beliefs, thoughts and actions.

Pointing-and-Calling raises your level of awareness from a non-conscious habit to a more conscious level by verbalizing your thoughts and actions.

Reciting the 5 Fundamental Truths each time you’re about to place a trade is casting a vote for the person (investor in this case) that you want to become. But is that enough?

You still have to live the experience, you have to wrap it around a meaningful context that has real purpose. (Did someone just say Skills Acquisition Plan?)

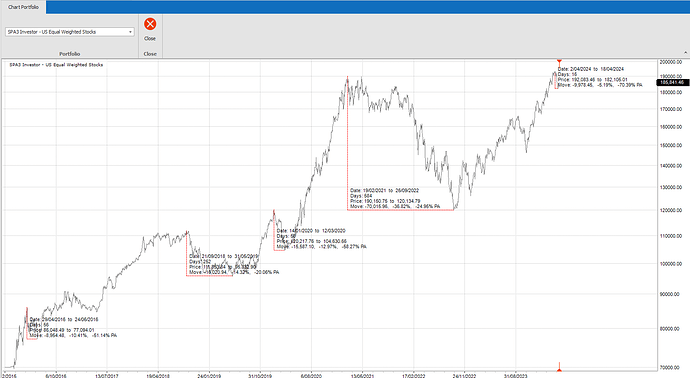

So, What’s the relevance of the chart below?

This is the equity curve of the US public portfolio from the beginning of 2016 to current.

Looking at the far right hand side of the curve, you’ll notice that the portfolio has just recently made a new all-time high finally coming out of a long period of drawdown.

You’ll also notice that no sooner did the portfolio reach a new all-time high, it’s once again experiencing some drawdown. It’s occurrence in a portfolio is like day and night.

Even large indices like the SP500 and the All Ordinaries spend up to 90% of their lives in drawdown. (It just means that they’re only making new highs 10% of the time…The questions is, which 10% of the time ???)

Now, casting your eyes to the left hand side of the chart you’ll see the first of 4 periods of drawdown. Each of the first 3 periods of drawdown are greater than 10%.

The fourth period of drawdown is 36.8% and lasted over 1100 days…a huge challenge, but nonetheless navigated with consistency and discipline of execution, and calmness and neutrality of mind.

It does take work, so here’s some tips to help you forge ahead with your transformation.

- Work your way through the 4 week Process & Mindset Intensive.

- Complete your Skills Acquisition Plan.

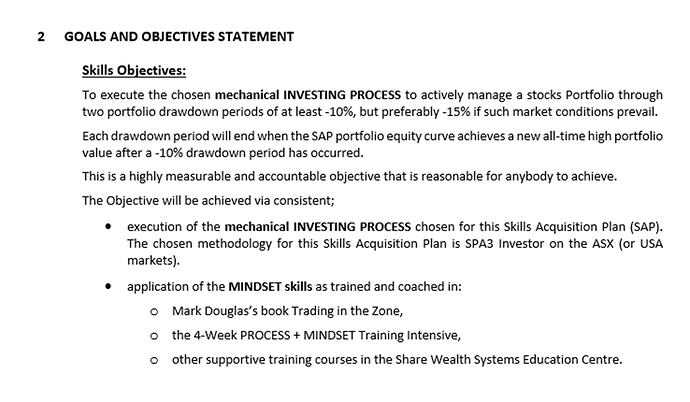

Many SWS members will already have Investment Plans, but I’d encourage all members to take a close look at the Skills Acquisition Plan and the goals and objectives section of the plan in particular.

Here’s a snippet from that section.

The process of behavior change (transformation) starts with awareness…so if you’re not familiar with this important document and how to use it, now might be just the right time.

Enjoy your week.

David.