What’s one way that investors “Self-Sabotage” ![]() their progress when using a Systemized Investing Process, such as SPA3 Investor?

their progress when using a Systemized Investing Process, such as SPA3 Investor? ![]()

Overriding the system and think you know more than the back tested edge. This can be more challenging particularly over the past 18+ months when performance returns of the edge have been low compared to the LONG term CAGR. To ‘catch up’ there will need to be some years with high returns. The good news is the public portfolio data shows this- a 50% year. Its all about the W/L and payoff ratio.

Thanks for sharing Stephen…great comment ![]()

Members, what might cause investors to “override the system”? ![]()

What are they hoping to achieve by doing so? ![]()

What are some good resources they might benefit from delving into…? ![]()

My biggest ’ fault’ was skipping trades that I thought weren’t going to work out. Never had a problem taking exits - but the initial buy sometimes caused me to hesitate.

Learning to think in probabilities has mostly fixed this problem.

Thanks Nick…Appreciate the honesty and Self-awareness. ![]()

Hesitation / Fear / FOMO are just a few of the mental challenges to overcome.

Well done on creating the new habit…“thinking in probabilities”. ![]()

Members,What’s some advice for newer members wanting to learn how to do this?

Why is it that we sometimes think we know how a trade is going to pan out?

For me, it was thinking that my subjective technical analysis was somehow going to tell me what was going to happen. I had the wrong beliefs and held onto them for far too long. ![]()

I used to do all the usual stuff. Like not take trades because of all the “noise” out there, not sell on a sell signal, sell early, not buy on a buy signal etc. The frustration I experienced over an extended period of time was immense. Then one day I looked back on what I missed out on in rising equity curve terms over the years from the GFC thru to about 4 years ago, and it REALLY ANNOYED me. I could use stronger language but this is a “family forum”. Cost me lots of $'s in missed rising equity curve. So I got my copy of “Trading in the Zone” by Mark Douglas that I bought back around 2004 off the bookshelf and read it again - twice. Then I got the audio book as well, and I listened to it over and over again. In the car going to work each day, walking the dog etc. After several times through, the penny finally dropped ! For the past 4 years, I have calmly taken each signal faithfully. I no longer read the financial press trying to figure out what is going to happen, freeing up valuable time. I just let the system edge play out. The edge has kept me out of trouble, stress free and made money. I now consider myself the “House”, and all those other market participants are the “punters”. I now have The Edge. History has shown over many years that Casinos have been excellent money makers. Despite all the glitz and glamour, there is a steady transfer of wealth from the punters to the House. Why? Because the House has a proven mathematical edge. I am not trying to get wealthy overnight, I just want to make a good return that beats the ASX 200 and the Active funds management industry over the medium to longer term. The best thing is my now stress free existence when it comes to the market. I just execute & let the edge play out over a large enough number of trades. I cannot predict the future - its just not possible, so I don’t bother trying! ANYTHING CAN HAPPEN. All that was needed to get me to this place was reading, no… “STUDYING” Trading in the Zone. Best book ever on trading psychology. Without the right psychology, I would still be struggling. This is what worked for me. Hope this helps…

If I started my trading career again I would follow the Mark Douglas/SWS 20-25 trade sample size exercise. I would make the amount risked so small it was irrelevant. eg Buy $500 worth of shares- if it is an outlier loss in the SWS its likely to about about 20%= $100 (ignore brokerage as a learning expense). If all 20 trades were the outliers (highly unlikely ) I would lose about $2000 maximum. If you struggle to execute flawlessly there are conflicting beliefs. Reward yourself if you can do it flawlessly eg nice dinner out. If you can do it flawlessly increase the investment in ‘sensible’ increments. Most traders do it the opposite to this- this is why so few make it…

Love your post Rob. Our journey’s are so similar it was like someone was reading/writing my thoughts. Mark Douglas is certainly the king of trading psychology and when I discovered SWS were devoted to his teachings, this was the place for me.

Great Posts Rob and Stephen. ![]()

The 25 Trades Exercise is such an underutilized activity, and all investors can learn from it, especially those using a fully systemized process. It’s a Key reason we ask all New members to complete it and encourage existing members to do it again if they are still facing some mental challenges along the way.

Having that level of Self awareness (which is one of the aims of the exercise) is so important in creating change. The “Penny dropping” moment as Rob called it.

Couple that with reading, no, “Studying Trading in the Zone” and things will start to fall in place.

We all wish we had these moments sooner so I encourage all members to think about their current state of mind and reflect on what Nick, Rob and Stephen have contributed. This is GOLD. ![]()

Paying forward their learnings so others might fast track their own growth and development.

Hats off to all of you! ![]()

I love the suggested rewards idea Stephen,…positive recognition for good habits (processes) regardless of the outcomes.

Note the way that these members talk and how they see themselves…the transformation that has occurred. It does take some effort and unfortunately there are no shortcuts.

I recorded this video for YouTube earlier this week before the comments above. It was published late yesterday afternoon, Fri 25th.

The overlap of some of my words with Rob’s comments above are quite uncanny.

Seems like so many of us have had similar learning journeys.

Hello, I’m relatively new here, having rejoined SWS in April this year after an almost 20 year hiatus (hello teenage children!).

I have completed the 25 trades exercise, and followed the SPA Investor rules to the letter during that time. I’ve incurred losses on most of my trades during that time, and am currently approx 5% under my starting investment. I have read Trading in the Zone, and watched the webinars/YouTube videos, and completed all of the (fabulous) Education resources before I started trading. I read the comments above and just have to “keep the faith” that my results will turn around over time. I have started with a small capital balance relatively to what I hope to invest eventually, to try to get my head around the psychology of trading. Thank you for the comments above, much appreciated.

Hi Sally

I think you need to congratulate yourself that (a) you did the exercise and (b) you executed flawlessly. In MD words YOU ARE TRADING LIKE A PRO. The buy and sell signals are generated in all market conditions and at present the market is not reaching all time highs. The Sharewealth public portfolio is still in drawdown from Nov 21 as is mine and many others. When will the drawdown end? We secretly would like to know but we can’t because we don’t know when the market will turn, when other big players will come into the market and push it higher- they will move the market, not us, we need them to push up prices (MD videos). Every trade I take (today will be BSL) I place a sticker in my journal with a gold star to remind me that my number one goal is to be Trading like a pro- get the process right and the outcomes will take care of themselves when the market turns. Hope that helps. Kind regards

Sally,

Sounds like you are (re)doing your “time on the floor”. Good work.

While the aim for our portfolios is to grow, portfolio equity curves, like indices, will spend well over 70% of their lifespan going down or sideways. This is the psychological price that ALL investors, not just active investors, have to pay.

The difference is that active investors get to see and feel the sideways and down movement far more directly.

Like all things in life, it matters not what happens, but what we do about what happens.

Nobody can control in advance the events of life. The same with the market.

So, as active investors we keep probing, in the ready, in the full understanding and knowledge that the sideways price patterns in the market are merely springboards for the next move.

Which, in the short to medium-term, could be up or down - we don’t know. Nor do we try to know. Our job is to be ready and prepared with a neutral mindset.

And then at some stage we receive our goods for the psychological price we paid during the down and sideways periods.

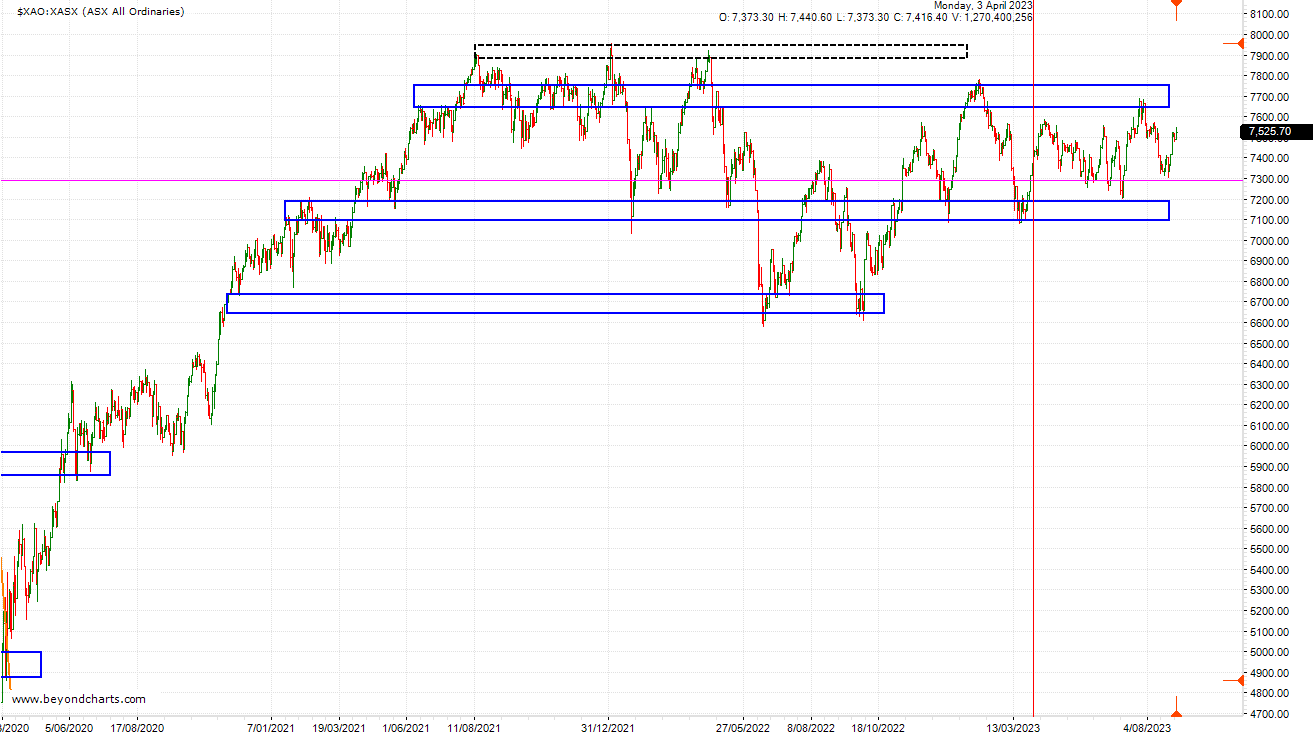

This chart of the All Ordinaries ($XAO) shows that it has range traded since August 2021. The value line date is 3 April 2023.

These are tough conditions in which to get a rising equity curve. And is most definitely a period where we pay our dues to the market, while it grows our resilience and mental strength by testing us.

It’s a great time to learn, gain knowledge, acquire skills and get prepared for the next up move (which could be after a down move but exits signals will provide protection). After all the market has an upward bias which will play out over the long term.

Most struggle through periods like this for so many reasons (excuses?) that ultimately come down to a lack of understanding, low resilience and not wanting to put in the hard yards to get the rewards on offer over the long term.

So, they stop actively investing. They stop being consistent…

Thinking that consistency is something they can turn on and off like a switch. They haven’t reached a level of understanding that consistency is the number one skill they need to get the long-term gains from anything, not only the market. (Yes, fitness programs & diets too! Or improving at anything!)

Thinking that they’ll know when to get back into the market when it starts rising again. Unfortunately, they seldom do, missing the great early trends that come before the next breakout to new all-time highs.

So, to truly learn the skill of consistency, so that you can be consistent when the market is rising, you have to be consistent when it’s NOT rising.

You can’t get good at a thing that you’re not doing! You can’t master what you avoid.

Sally, although written in response to you, this post is for everybody to read.

You would’ve done The 5 Key Skills for Peaceful Investing course in the Education Centre recently.

When the market is going sideways is the best time to redo this training to take us all back to the basics of active investing and improve our mental skills.

Great Posts…lots of fantastic feedback.

Rather than letting those thoughts sit here, why not take a copy, print it out and keep it handy. Habits are about creating change in the way we act and in the way we think.

And tuning into the right thoughts can be difficult when you’re still learning how to think like a disciplined consistent investor.

The thoughts and context Gary shares above are just so profound…mindset coaching at its absolute best.

Thank you Gary and David (and fellow SWS users) for these replies. Great reinforcement for all of us. And application to lots of other areas in life too.

Sally

Hi Gary

Thanks for the post and I agree that the last few years has been challenging.

My question/comment is in relation to the edge. The SPA3 Investor ASX equal weighted portfolio has beaten the benchmark by 3.87% pa which is great.

The US equal weighted portfolio has underperformed the benchmark by 1.13% pa, so no edge?

I have traded the ASX equal weighted since 27/04/2020, the system has underperformed the benchmark by 6.99% pa, which has been quite frustrating

I have been consistent with following the signals and remaining actively invested

As we know in trading, anything is possible… so I’m guessing that a trading system that had an edge, may at some point no longer retain its edge, as nothing is guaranteed?

Paul,

Thank you for your questions, allowing me to respond with data that regularly ticks over in the back of my mind and which I personally take a look at about 3 – 4 times a year to gauge how my portfolios, and hence my customers portfolios, are performing relative to alternative investment avenues.

You’ve been nice and specific in your question so I’ll try to do the same in my response.

I’ll answer your last question up front. It is very possible for an Edge to lose its Edge. But that’s not what’s happening here with SPA3 Investor’s ATR Buy/Sell algorithm.

I’ll provide perspective and examples here to substantiate that answer.

Some comments about ‘Edges’ to start …

An Edge for trading / active investing (remember ALL Funds are active, even index ETFs) is to be profitable, after costs and fees. This is the starting point with trading system design.

But, just to be profitable wouldn’t be good enough relative to alternatives (even tho the majority of stock market traders continuously lose money let alone beat the TR index).

SWS sets a pretty high benchmark for the Return Objective in our ASX & US Public Portfolios: to outperform the Accumulation / Total Return index by 4% annualized.

Higher than any others I can find. Please let me know if you can find higher.

That benchmark is based on simulating 100’s of historical portfolios since 1998 (to capture at least 2 severe bear markets). Then setting an Investment Plan Return Objective at ±75% of the average CAGR achieved in the simulations, to allow for the difference between simulating historical data and trading future data.

Our multiple simulations started on different dates with different #s of positions to get different mixes, averaged in the 20% - 25% annualized returns. I rounded down to 20% * 75% = 15% annualized. Then averaged a number of TR indices in the US and ASX to arrive at 11% annualized to represent a basket of indices. Voila, 4% the difference.

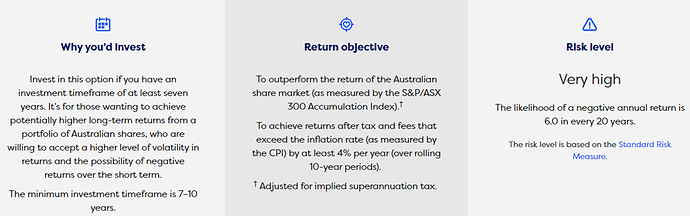

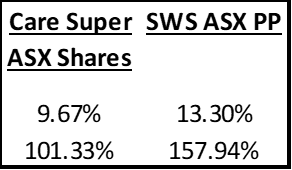

Other investment avenues are not as definitive as SWS. For example, this is Care Super’s for their Australian Shares fund, which attempts to be 100% invested in ASX stocks at all times.

Note the timeframe of 7-10 years. And the Return Objective, of which there are 2! Their Growth Fund states only the second Return Objective stating exactly the same as this one, but both use the second Return Objective as their graphed benchmarks on the website.

The Montgomery Fund states rather loosely: “seeks to outperform the S&P/ASX 300 Accumulation Index over the medium to long term.”

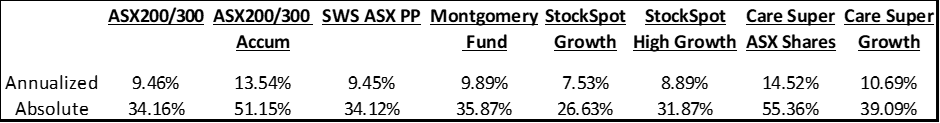

Here are some returns from other avenues of investment, all measured from 30/4/2020 to 31/7/2023 (latest for some):

Whilst SWS’s ASX Public Portfolio has underperformed the Accumulation index for this period, so have others underperformed their benchmarks for the same period.

Marcus Today’s Growth SMA has fared worse than The Montgomery Fund over this period (in fact since inception).

My two points from this table (and the chart below for MAN AHL) is that all Edges underperform their benchmarks at times. This doesn’t mean they are broken. But it also doesn’t mean that then underlying philosophy of the Edge and its parameters shouldn’t be retested and potentially tweaked.

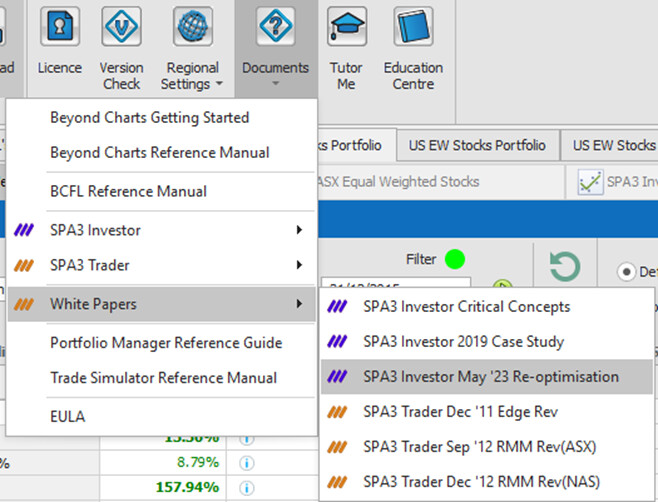

Which is what SWS did last year with SPA3 Investor, when drawdowns on both the ASX and US markets exceeded our researched expectations. A White Paper in available in the Beyond Charts HOME tab, under Documents for this research project.

The only outperformer in the table above is Care Super. This is the comparative performance since 1 Jan 2016.

SPA3 Investor uses a volatility adaptive trend-following algorithm. Which will struggle more than other approaches in the type of market I showed in the $XAO chart above. None of the others use trend-following from what I can ascertain.

This next comparison is more to show how Edge’s based on sound principles don’t disappear forever.

I’ve been following MAN AHL for years because they use systematic trend-following principles. They deploy numerous mechanical systems in this fund across a few asset classes. I’m sure we have customers with money invested with them…

Since inception they’ve had two long drawdown periods slightly deeper than 20% both lasting for around 6 years before new all-time highs occurred. They’ve stuck to their investing philosophy. I’m sure with tweaks to their systems…

RE the US Public Portfolio . I’ve just recorded a video on the it’s last 12 months’ (and other periods) performance. It grew by 25.04% compared to the S&P500 TR being up by 15.94%. If the Edge had been deemed broken a year ago and a US investor had retreated to a Balanced Fund such as Vanguard’s, they would have achieved a 7.56% return for the year.

There are plenty more points that could be discussed. And these points can become deeper discussions if performance is analysed over the different and longer periods. But I’ll leave it there for further questions and discussions on this thread.

Paul, I’ve obviously written this response for all readers’ benefit. The two main learnings from this are:

- Be specific and realistic with your investment horizon / timeframe, Return Objective and Risk Objective in your Investment Plan.

I like the idea of including the expected number of negative years. Could even take this further and define the % of time that an equity curve is expected to spend in drawdown. Will discuss with Dave for the Public Portfolio Investment Plans based on doing Simulation research.

- Edges are consistent but not constant. If they are based on principles that have worked for decades, they will continue to work in the future, but will probably need iterative improvement / tweaking from time to time.

Also, aligned with this point, drawdown (down and / or sideways) in equity curves can occur for long periods of time. This seldom means that an Edge based on sound concepts is broken forever.

It certainly is tough to trade through a period such as the ASX has had since April 2021 (see chart in post above). As active investors, we see and feel far more than less active investors. However, most of the time those inactives are experiencing worse returns that us, they just don’t know it…

To close, I reiterate my closing comments to Sally above. You can’t get better at something by avoiding it. That something in this case, is handling periods of drawdown and underperformance. They are part of the journey.

That said, by you ![]() , anything is possible and there are no guarantees. Or: “Anything can happen.” So, we just have to go with and think in probabilities…

, anything is possible and there are no guarantees. Or: “Anything can happen.” So, we just have to go with and think in probabilities…

Long-term successful investors seek consistency. Which we can’t attain by being inconsistent with our habits and actions. Doesn’t mean it will be easy…

Thank you again for your questions. Please ask more if you have them…

Thanks Gary for the detailed reply/analysis, much appreciated ![]()

I will continue to remain consistent and follow the signals

![FCX: Loss Trade | Systematic Trading Tutorial: FCX Freeport-McMoRan Inc [25 August 2023]](https://forums.sharewealthsystems.com/uploads/default/original/1X/7fc6b7457318b3ff7af53025e22293c51e245545.jpeg)