The Transurban share price was placed into a trading halt earlier last week so that it could undertake an equity raising to support its acquisition of the remaining 49% stake in the WestConnex toll road network from the NSW Government.

Whilst TCL is not currently part of the ASX Equal Weighted Public portfolio, this is how we would handle the Retail Entitlement Offer.

The Share Rights (TCLR) would be sold at market once they appear in the broker account. This action is consistent with previous reactions to these matters - typically we do not buy extra shares when an offer is extended as we’ll not know in advance the status (open/closed) of the stock when the shares will appear in the account. (We don’t want to hold shares in a closed position)

Your situation may be different, please ensure it is consistent with your investment plan or if there is no rule in your investment plan, write in your action to stay consistent going forward. We recognise that customers situations may be different and due diligence should be practiced.

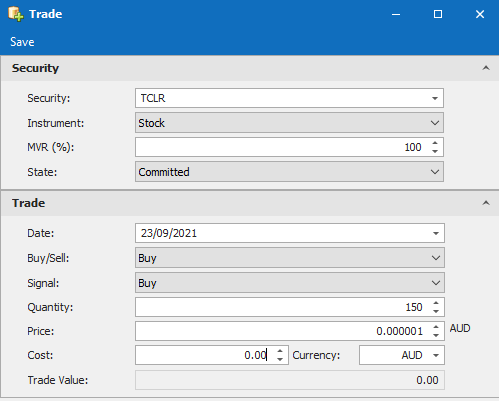

The acquisition of these rights could be recorded as a New Trade with the price of 0.000001 and zero brokerage.

If the rights are then sold the proceeds can be recorded in the trade ticket, to capture the brokerage paid as well as any gains made.

If you have any further questions, please continue the discussion below.