Good morning members,

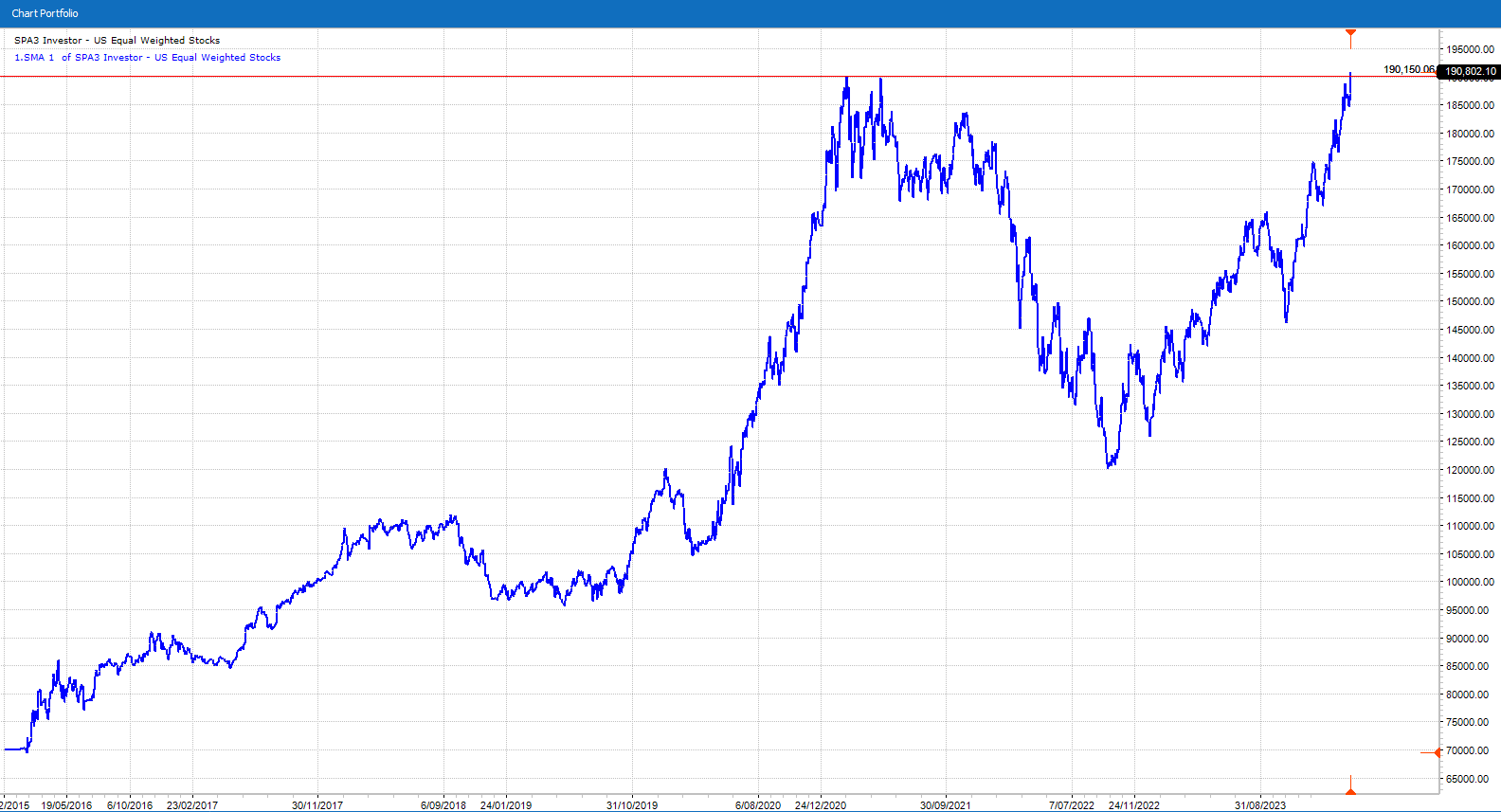

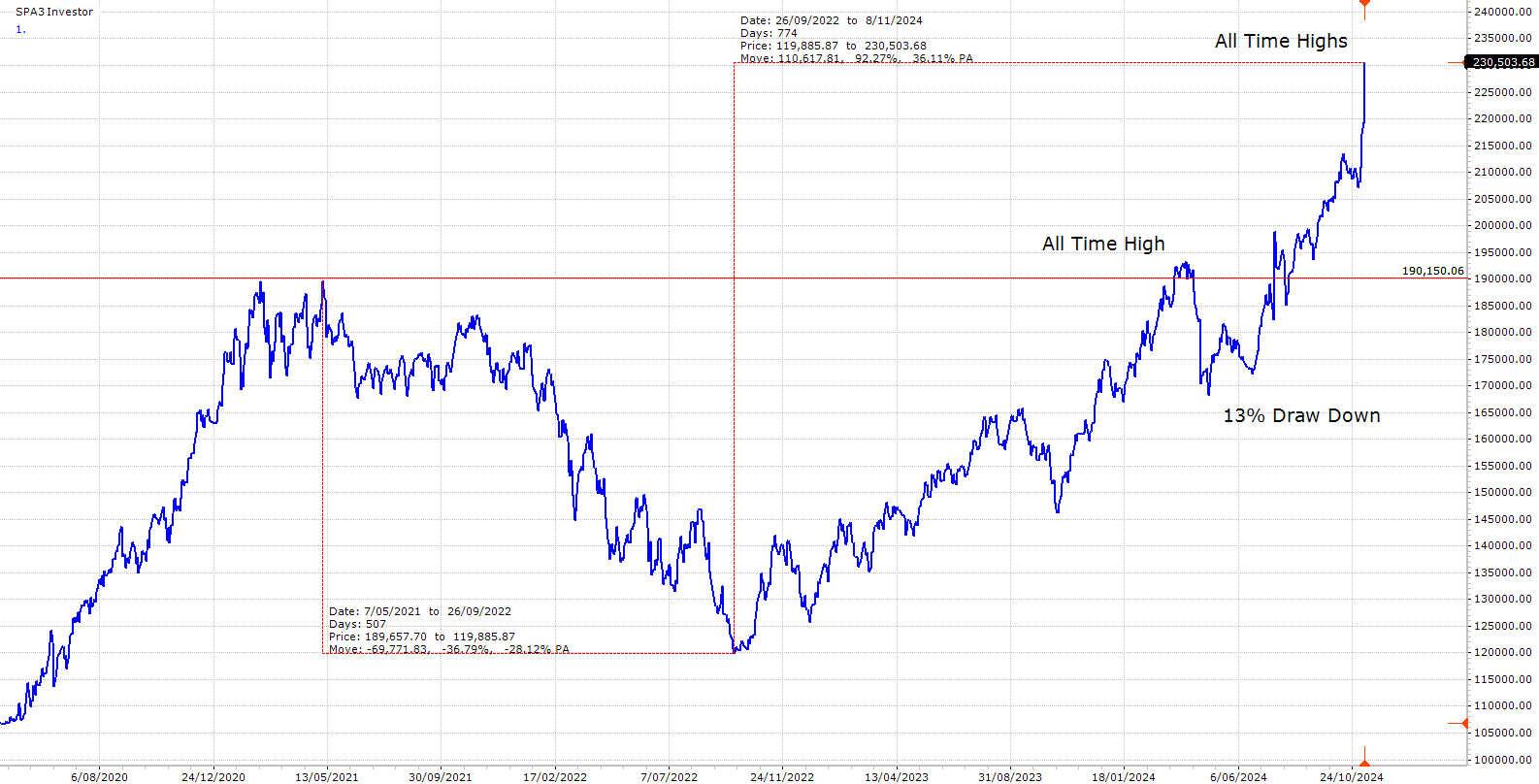

The Share Wealth Systems USA Equal Weighted Public Portfolio has now reached a new all-time high after 1125 days in drawdown.

This can now be seen on the daily plotted equity curve within Beyond Charts.

Tomorrow, in recognition of this Gary will be running an impromptu Connect & Grow Webinar to discuss evergreen lifelong trading lessons for all of us.

Keep an eye out for your invitation in your email. ![]()

The 4 Week Process & Mindset Intensive includes an important session on the Skills Acquisition Plan (SAP) that all members are strongly encouraged to download and complete.

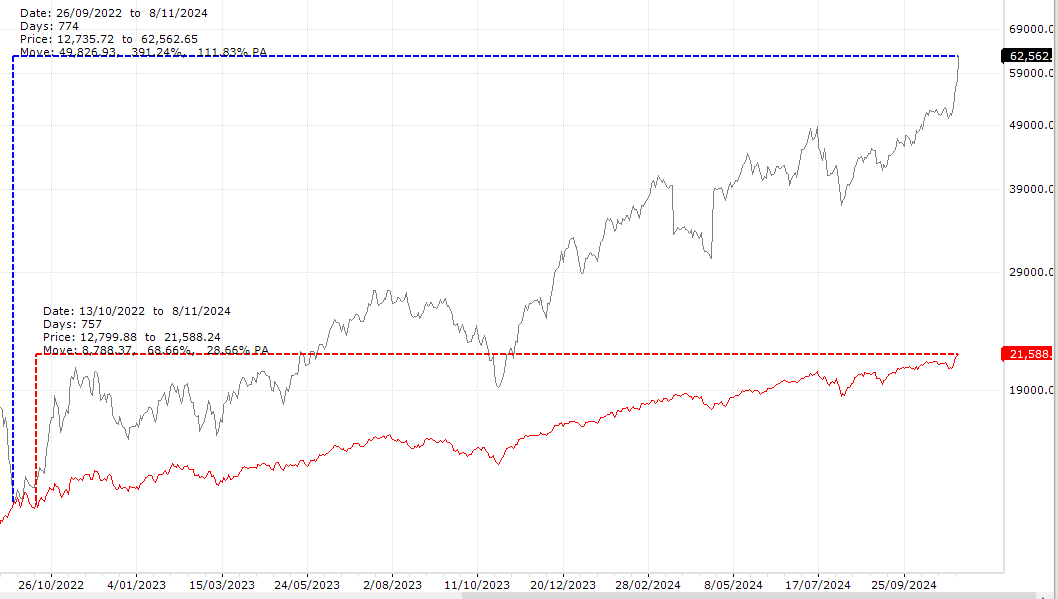

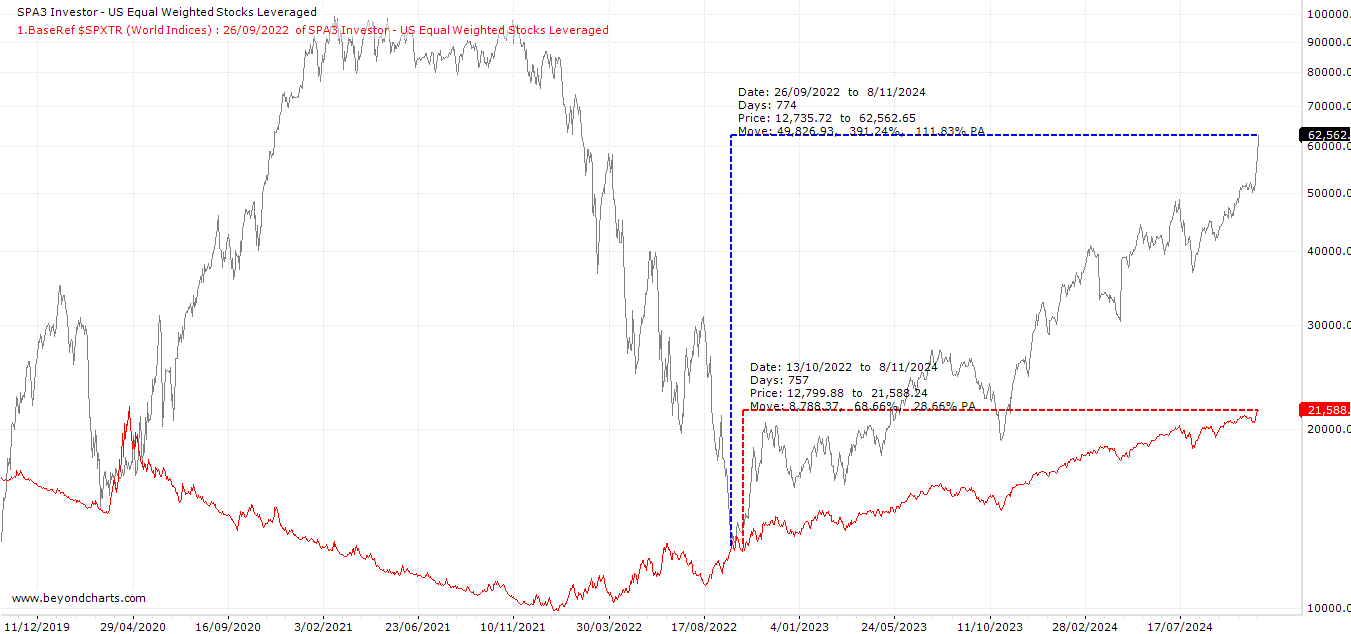

A Key Skills Objective of the SAP is to execute the chosen mechanical investing process to actively manage a stocks Portfolio through two portfolio drawdown periods of at least -10%, but preferably -15% if such market conditions prevail. ![]()

Each drawdown period will end when the SAP portfolio equity curve achieves a new all-time high portfolio value after a -10% drawdown period has occurred. ![]()

This is a highly measurable and accountable objective that is reasonable for anybody to achieve and the public portfolio is just one example of this.

When you truly accept the risk on each and every trade and think with a probabilistic mindset, you’re well on the way to becoming a peaceful and active investor regardless of market conditions.

That’s freedom. ![]()

Regards,

David.