Hi Simon,

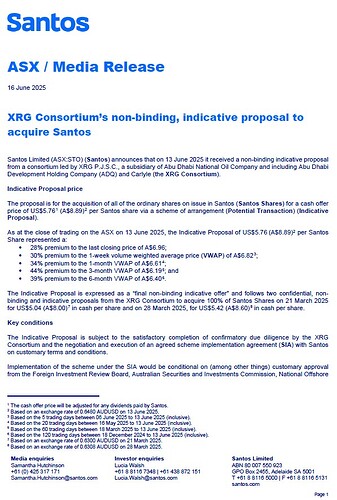

Santos (STO) is being considered for a Takeover, and this can represent a potential risk to holders of the stock.

How so?

Takeovers can be very complex and sometimes may even result in trading halts for an unknown period of time, meaning that the shareholder’s capital can not be accessed.

Whilst this is unlikely, it is a scenario that must be considered.

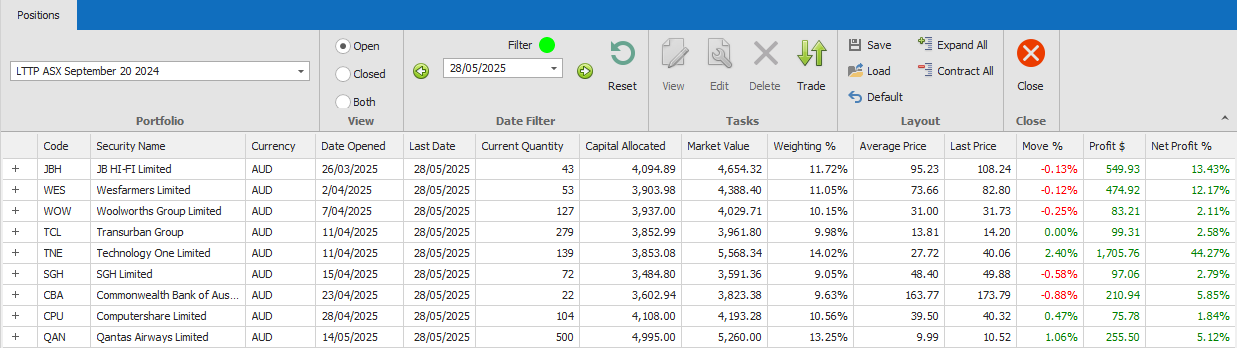

It’s for this reason that the SWS Public Portfolio Investment Plan has a documented course of action for any candidate that it may be holding, that becomes the subject of a takeover.

An Investment plan is a document that all investors should have which clearly outlines the investing objectives, methodology, money management and risks.

It should also provide for a range of different scenarios that could pose potential risks, for example, not being able to access the internet whilst on holidays and having your capital fully exposed to the market. What could one do in this instance?

The answer to this should be documented in your Investment Plan.

What would you do if you became aware that a stock you held became the subject of a takeover, and your funds could be frozen as a result of a lengthy legal process?

The answer to this should be in your Investment Plan.

Ideally, your Investment Plan will cover both scenarios above. There could be other scenarios that you may not have considered, or not even be aware of that will come up at some stage.

The objective is to try and think about what “could” happen and prepare an appropriate response “should” it happen.

For background and further context, you can download the SWS ASX Equal Weighted Stocks Investment Plan here.