Hi Ivor,

Thanks for your post.

The SPA3 investor stocks universe has not always consisted of the current 40 stocks in the watchlist.

It started off with just 14 stocks. Then as further research was conducted and suitable candidates met the specific criteria they were also added to the list over several years.

So, you need to be careful when you are trying to capture what might have been. For example, in your analysis you will have positions in stocks that were not available at that time. They would not have been in the list and yet they will be contributing to your results.

The closest research that you can do quickly is to run a simulation that buys 40 stocks and “Mimics” the SPA3 Investor Universe. It takes only buy signals and never sells.

If you do that over the same time as the public portfolio you will see that it actually underperforms the Public portfolio, and that it also has very large draw down.

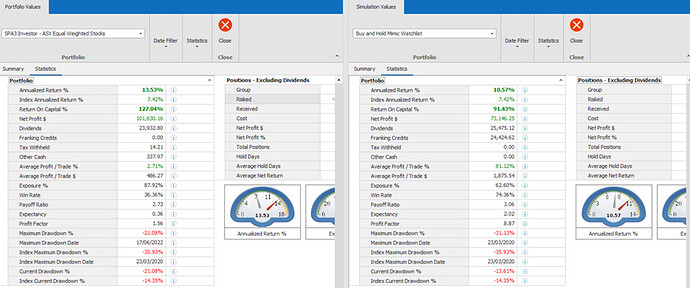

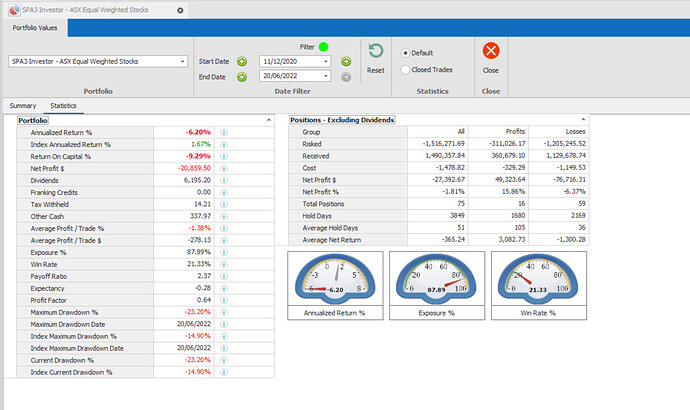

Here are the results.

We could also see what might have happened if we knew in advance which 40 stocks were going to be in the watchlist and run a simulation Portfolio to include all of them from 2015. That would be a fair comparison to your research using all 40 stocks.

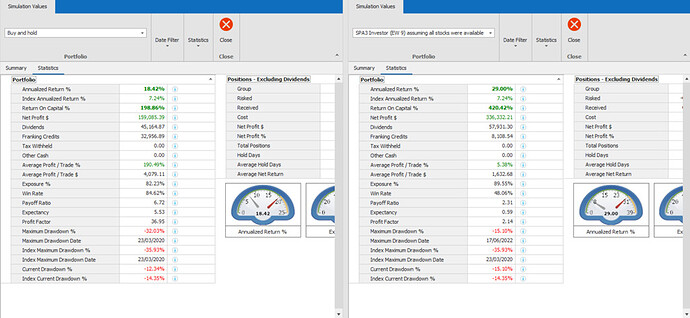

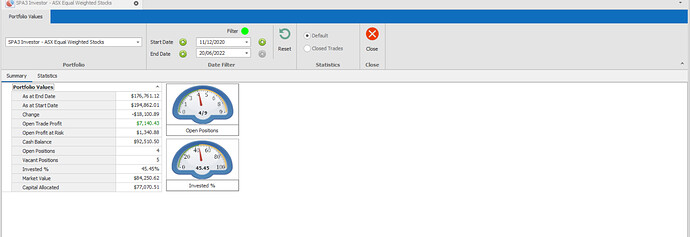

Here are the results.

As you can see, the SPA3 Investor Equal weighted portfolio with 9 stocks easily outperformed the buy and hold portfolio you researched. So, would it be worth the time for the difference in performance? I’ll let you decide.

But remember that the results from this simulation are not possible to achieve. We didn’t know back in 2015 which stocks were going to be in the current watchlist on which you’ve based your analysis.

It’s a little like having the winning lotto numbers today for tonight’s draw.

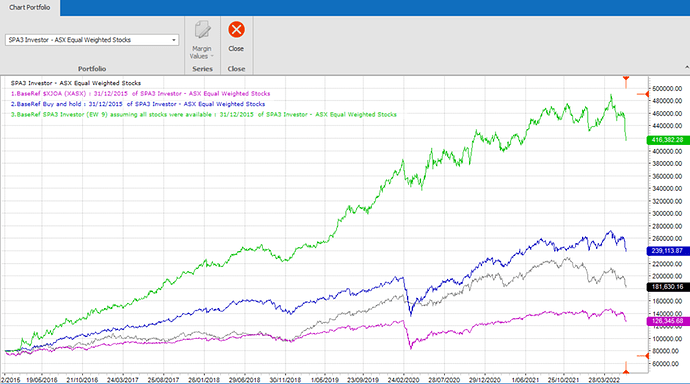

The relative performance can also be seen in the Equity curves of each scenario below.

The green line below represents the SPA3 Investor ASX portfolio simulation using 9 positions from the current list of 40 stocks had they all been available at that time……which of course they weren’t.

The blue line is buy and hold those 40 stocks.

The black line is the SPA3 investor real life Public Portfolio

The Pink line is the ASX200 Accumulation index.

SPA3 Investor is a Decision Support System, and it aims to help investors decide when to be in the market and when to be on the sidelines.

In a rising market Buy and Hold will in many cases beat the use of timing……until such time that it doesn’t and the “holding” contributes to excessively large drawdowns.

Bear markets and when they occur in your investing lifespan matters and is referred to as Sequence of Returns Risk (SORR).

SPA3 Investor aims to help reduce SORR through the use of timing.