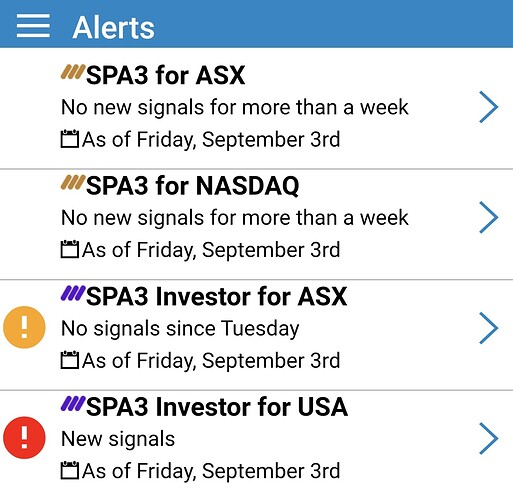

I checked my alerts this morning per the app and noted that it stated no signals since Tuesday. However, on Thursday night, an alert for BAP for Origin was signaled that I actioned on Friday. It’s now no longer listed. Can anyone tell me what’s going on?

Cheers

Chris

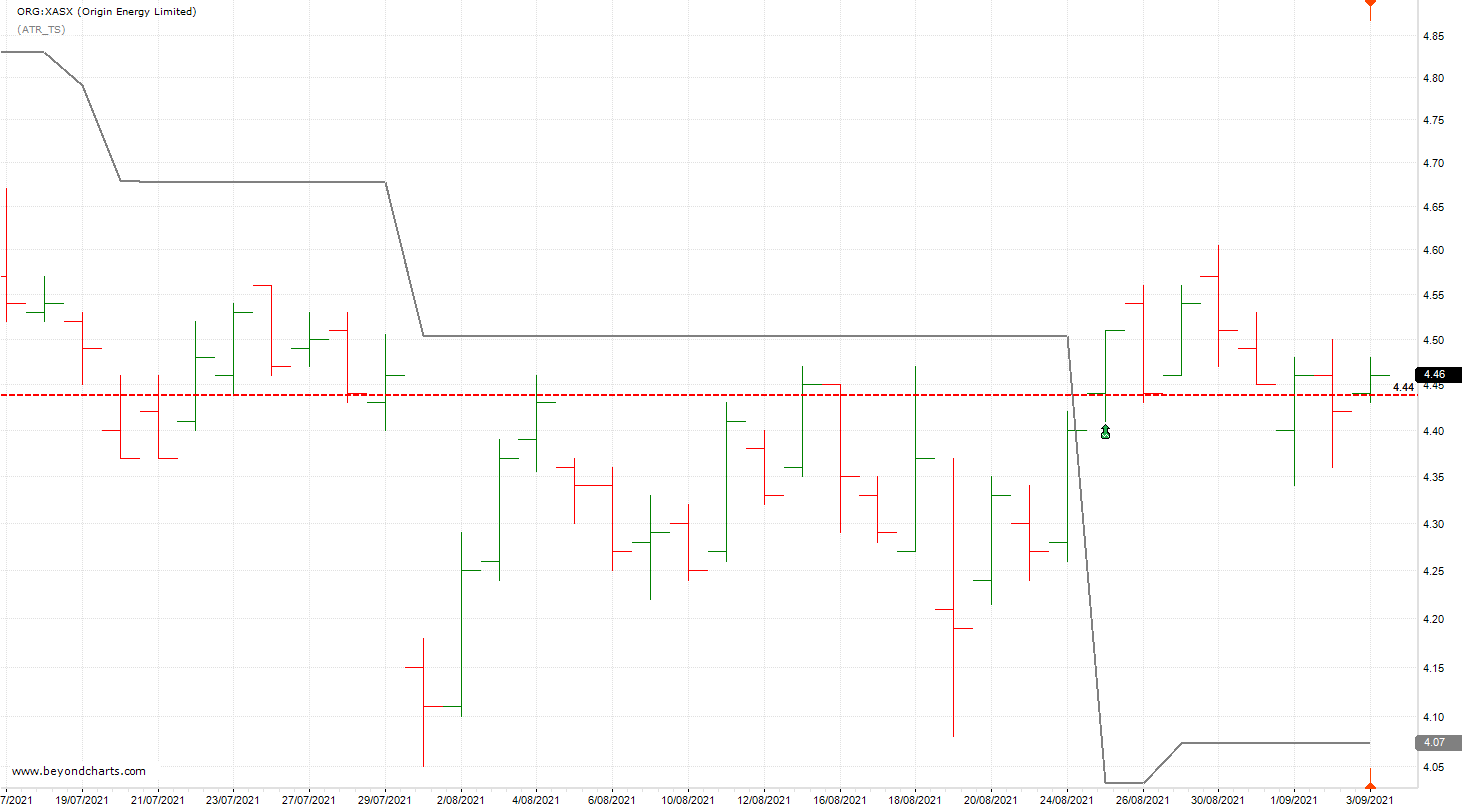

Hi Chris, Origin closed at these prices starting on the Signal day (25/8) 4.51 4.44 4.54 4.51 4.45 4.46 4.42 4.46 i.e. the only day where closing price less than the 4.44 Action price from 26/8 was Sept 2 when it was 4.42 … I guess that was the day you saw BAP (Below Action Price) … rob H

Chris,

On Friday ORG closed at $4.46, which is above its Action Price of $4.44. So it’s no longer a BAP (Below Action Price).

With no BAPs listed for Friday, this means that all SPA3 Investor Open trades (i.e. last signal was a Buy signal) are above their Action Prices.

Regards, Gary

PS. Action Price is Close price on the day after the Signal

Hi

I had NO alert on the App on Wednesday , and no alerts on Friday, after that we have just sorted out a glitch in the App that failed to highlight the Rank of the recommendations. .

I believe we should have an alert on the App on every day of the week. when there are no recommendations to follow the alert could identify it. This way we know there is no glitch in the system and that we have not missed any alert along the way.

Thanks

Maybe I’m missing something, but I seem to get an alert every day for each product I own?

The App also tells me when it last updated that information, points to the last day any signal occurred on, as well as highlights them with a big red or orange symbol on the left too…?

Thanks for your responses. I just can’t understand why it says there are no alerts since Tuesday on the Friday alerts knowing that there was an alert on Thursday night

Below Action Price notifications are not a signal alert and disappear the next day.

Hi guys I had TCL appear on the BAP alerts but it hasn’t traded since Monday. Anyone else receive this one? Price is 14.062 on the alert. (vs LAST 14.20)

It has something to do with the rights issue. The last closing price before the halt in trade was $14.18 (not $14.20). So if you multiply $14.18 times 9 (for the amount you hold to get 1 at $13.00) it equals $127.62 then add the one at $13.00 to get $140.62. Then divide that by ten (presuming you buy one at $13) and you get the value of $14.06.

When the market opens tomorrow, the value of 1 TCL will equal $14.06 (whether you take up the rights issue or not). From there it could trade up or down because “anything can happen”

Fantastic thanks Phil

Anyone have thoughts on the TCL Rights Issue? The new shares will be offered at $13 for those already invested, which is a decent discount to the ASX price so it seems like the logical thing to do is take up the rights issue and sell my current parcel. Am I missing something?

You should follow what is in your investment plan. If your investment plan does not have a rule for that, then you should make one and do it for all the times a rights issue comes along. Keep in mind that your position size won’t technically be evenly weighted. The public portfolio does not buy rights issues so the edge is based on (amongst other things) not buying rights issues. That may or may not be a bad thing, Long term it probably makes little difference.