Hello everyone,

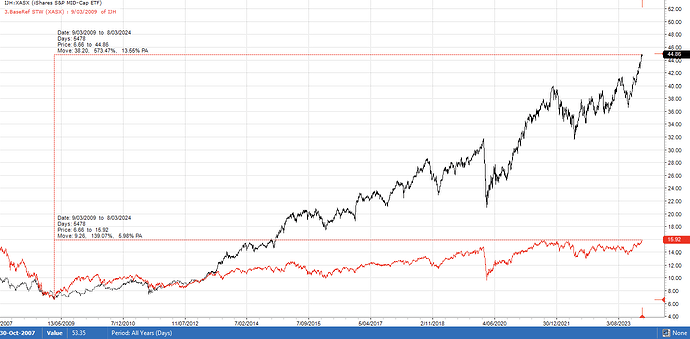

I am running an “IJH.ASX with SPA3 Investor Timing” portfolio in my SMSF. Last Friday, 8 March, IJH’s performance over the previous 15 years was 13.55% p.a. (see chart below). Given this long-term performance, I am considering leveraging my SMSF IJH portfolio.

As you may know, an SMSF must enter a Limited Recourse Borrowing Arrangement (LRBA) with the lender to borrow for assets. After some research, only one lender/product - NAB Super Lever - will lend to an SMSF to purchase shares/ETFs. (There are around ten lenders if the SMSF wants to borrow for a property.)

NAB Super Lever rates are 10% p.a. for under $250,000.

I have a few questions for Forum discussion:

-

Does anyone have an SMSF LRBA for purchasing shares/ETFs? If so:

a) How long have you had the margin loan, and has your experience been positive?

b) How easy is it to buy and sell shares/ETFs that are under a LRBA?

c) Other than NAB Super Lever, do you know other SMSF LRBA lenders/products for shares/ETFs?

-

What are your general thoughts on borrowing for shares/ETFs in an SMSF? Is it something worth considering, or is it not worth the effort for the additional gain?

Thank you.

John