Phillip, could you advise which instrument you use to hedge AUDUSD and do you only hedge against a rise in the AUD?

I also use Schwab and find them very good.

I have used Saxo for 2 years investing in the ASA market and have done 2 tax returns for my SMSF. My accountants have never had a problem with the Saxo reports for tax time

Hi Peter,

I use the Saxo platform (SaxoTrader Go) and the AUDUSD CFD expiring every 3 months. It is leveraged 25:1 so for example if I have $500,000 in USD (including positions, profit and cash on hand) and our dollar is 0.70c then I would need to hedge AUD for $714,000. I would buy $714,000 worth of the CFD which would cost me $28,560. You need to leave about 20-30% extra in Saxo to be safe without getting margin calls. Total of $40k would suffice. Saxo pay no interest on the cash in the account. I only ever go long. It looks easy to go short and get it both ways but Gary advises long only, and he was the one who recommended the sort of instrument I should use. There is a daily Carry Cost for the margin and on the example above it would work out about $1 a day. If you were intending on leaving money in the US for a very long time, the hedge may not be as critical, however if you are near or at retirement and will be drawing on funds within 10 years, it may be more prudent to have. This is not advice but just my view.

The buy/sell spread with Saxo is around 3 pips for small accounts, but can go lower for larger accounts. Since FX is volatile and voluminous, and the hold period is usually medium term, the spread is negligible to the outcomes, as is the Carry Cost.

Many thanks Phillip - as well as US stocks I have a number of USD bonds which have suffered in recent AUD rise. As you say - not a problem if you are there for the long term but handy for shorter time frame.

In regards to SAXO reports, I find the SaxoTraderPro platforms Quarterly / Annual Performance reports ok, however, for my Financial Statements / Monthly Trade summaries etc, I log in via the ‘old’ web-based platform via https://www.onlinewebconnect.com/login/en and run them from here still. The formatting and layout seems to be much better than the new platform. My accountant also has had no issues with them.

I have a SAXO AU account and a US sub account. I want to trade US more frequently, and the commission is high for my smaller amounts. I have a Trust account - is there any US broker account I can use for lower commissions or zero, that people recommend that will allow me to trade? Thanks for feedback everyone

Hi Craig, Try Charles Schwab, they charge $0.65 as a contract fee for online options contracts and zero commission on online Options and Stock trades. There is also an exchange process fee for buy and sell orders which is levied on them by the exchange that they pass on but it is small. When I set up my account some years ago the name of the account had to be the same as the bank account name in Australia (mine is also a trust) to comply with the US patriot act. So check that with them before you open an account.

I was of the belief that a number of the US brokers had pulled out of Australia over the past couple of years and were not opening new accounts.

I know Saxo and Interactive are still offering accounts to AUS.

But I though that Schwab, TD America, E Trade et al were not opening new accounts.

Anyone have any ideas, or perhaps a list of who is and who isn’t - opening new accounts I mean!

Hi,

Have any of you longer term Schwab customers ever run foul of the US market’s anti-freeriding rules in your years of operation?

When I was first with Interactive Brokers, I tripped with these rules accidentally twice in highly unusual trading situations - one from memory was correcting an error trade. There are a number of these rules but the one I encountered was in buying a stock with unsettled funds and then selling it before that trade had settled. This is of course perfectly fine on the Aust market and the only way I found out about the issue was when my account would work normally, due to the penalty of not being able to trade at all with unsettled funds for 90 days - a severe penalty.

I spoke to Schwab this afternoon and indeed it applies these rules with penalties of 90days without being able to trade unsettled funds on the first violation, and then permanently after the next violation.

Interactive Brokers has, since I commenced with my account with them, set up an Australian office and the accounts of Australians/SMSFs are now domiciled here. One of several benefits of that move is that the anti-freeriding rules no longer apply to these accounts for US market trades. I reconfirmed that this afternoon.

For me, this at least partly offsets the attractiveness of reducing my very low IB brokerage to zero with Schwab.

Mike, Schwab was this afternoon perfectly happy to set up new Australian accounts.

Regards

Don

Done it twice with Schwab. Both times I just got a warning letter. It is a bit deceptive, because when looking at available capital, it shows you cannot withdraw the unsettled funds but it appears such that you think you can trade with it. Having said that, when you are placing a trade with unsettled funds it comes up with a warning that looks similar to the warning that your price is over the sell price and the trade will be successful - so unless you are diligent you will miss the warning. Anyway, the warning letter only said 'may result in …" not “will result in …”. It only happens when you are fully invested and you sell a position and another is immediately available. As it all usually happens during the night, I get the next day to think about the buy and since anything can happen, waiting another day may or may not be a disadvantage, and if in your trading plan for that set of circumstances, should not affect the long term results.

If anybody is considering using OFX to transfer between AUD and USD, or vice versa, you can contact Samuel Pitt at OFX.

**Direct: 02 8320 3683 | M : +61 439 868 698

**Email: samuel.pitt@ofx.com

Regards,

Gary

Phillip,

I forgot to ask if you use any sort of Stop on the hedging position or simply monitor manually?

Regards Peter

There is an SWS trailing stop on AUDUSD FX Spot (it will come up on the Securities Explorer in Beyond Charts) which has buy and sell signals. It also comes up on the SWS app when there is a signal. I use that and the AUDUSD CFD reflects the same movement and price (within a couple of pips at any point in time)

Thanks Don.

Appreciate the update.

I guess my question about trading with a stop in place is to do with the fact that a spike can close out a trade where the sell signal does not occur as Close is above Stop Loss line. The only way I can see to achieve this is to manually close trade once signal has occurred. Does this make sense?

Hi Peter,

If you are saying that you would put a physical stop on the platform you are using, then a spike will take you out. I do not do this and only follow the SWS signals from the Beyond Chart program - which is on the closing price of the day.

If you are putting on your own stop on the platform, based on the SWS trailing stop, you would have to manually check every day on any movement and then risk getting stopped out mid stream - not ideal, and it destroys the edge from SWS.

The current position on audusd is open and if you had have been putting the stop physically on the trading platform, you would have been stopped out at least 4 times intraday on this open position, the last of which was 2 nights ago where it has rebounded back this morning to a cent higher.

Sounds reasonable. Thanks for all the help.

Regards Peter

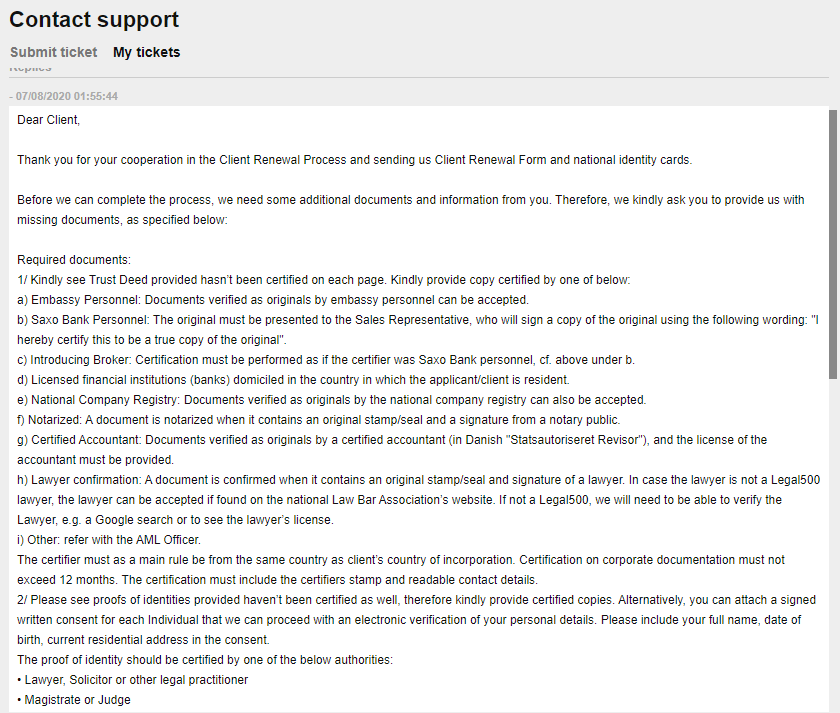

Just received a ticket from Saxo to provide more information to keep my Super account with them open. I’ve already provided everything they asked for a few months ago. Anyone else in the same position?

I use Saxo but only for hedging. Have not had a request for any of the above. Below are my opinions only, not advice. DYOR

1 + 2: docs can be certified at your local Chemist Warehouse by the Pharmacist. Should be no charge.

3: Obviously a corporate trustee so directors should sign - not sure about Deed of Guarantee for an SMSF - check whether what you are intending to trade is allowed under the SIS regs.

5. LEI - Need to check out depending on what instruments and which exchanges you are trading. LEI may be superfluous.

6. If in SMSF cannot be 3rd option.

They are asking, amongst other things, Embassy documents. Is this due to immigrating from another country or not being an Australian national?

I am with Saxo also but have only been asked to verify SMSF matters once a year.