Hi I’m wondering if a MOO would be better than MOC for sells?

I understand that there is only a slight difference between MOC on the asx although in the US the amount is much larger.

Thanks for any input

Hi I’m wondering if a MOO would be better than MOC for sells?

I understand that there is only a slight difference between MOC on the asx although in the US the amount is much larger.

Thanks for any input

Hi James,

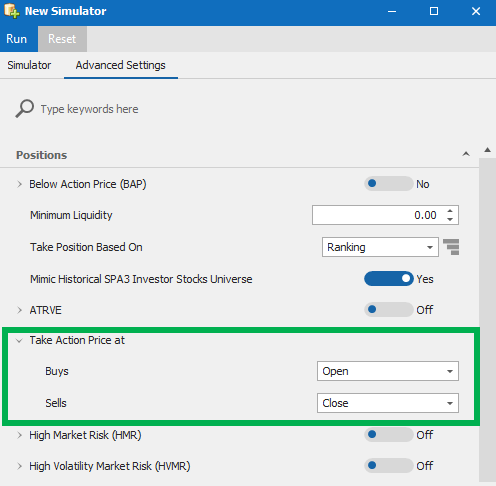

You can test this out using the Simulator in Beyond Charts. On the second tab (Advanced Settings) you can select how the simulator trades by selecting the relevant option under the “Take Action Price at” menu (See below).

You can run further simulations to explore other combination as well. To get the full picture it’s important to run a range of simulations over various time frames and market conditions.

Below are two simulation that start on the same date as the public portfolios showing the difference between MOC orders for buys and sells…and then MOC orders for buys with MOO orders for sells… per your post.

Hope this provides some insight into the use of the simulator in relation to your question, and how it can be used to explore other scenarios as well.

Hi David,

Thanks for the input and education. I enjoy being able to test the edge and also try different parameters. MOC BUY AND MOC SELL is the clear winner for my simulations. I will try and make different date simulations over time.

For anyone interested here is a few examples I have made

MOO MOO

MOO MOC

MOC MOO

MOC MOC

Thanks David for the help.

Hi James,

Thanks for sharing your work! Its great to have the ability to backtest different scenarios to reinforce established best practice.

This might well have been dealt with elsewhere in the forum but I can’t see a MOO order in the algo area of SaxoTrade. I’d be grateful if anyone could tell me whether you can place an MOO order and if so how?

If you put the price substantially higher than the indicative opening price (not sure if Saxo displays it but other brokers do), then you will get the opening price for the day. The closer to the open, the closer the indicative price becomes.

Saxo have both MOO and MOC options in pre-market open

To achieve a MoO order with Saxo merely place a Market Order before the market opens and you’ll get filled at the Open Price.

I’ve done this many 10s of times both for Stocks and CFDs on each of the US and ASX markets for both Buy & Sell trade tickets and only had a handful of transactions that weren’t filled at the official Open Price.

And even then were very close to the official Open Price.

Thanks very much for the information

Peter