Hi all, just watched the April 9 video and want to apply the market risk filter to my trading at this time but can’t recall how to do it, there doesn’t seem to be a button to apply those signals. Can anyone enlighten me please? As Gary said I do feel the losses 2x more the gains so give the tariff situation I’m happy to reduce trading even if it costs gains later.

The SPA Trader shows Market Risk High on the app. SPA Investor used to have a volatility stop at 3.5 which was on a chart that I can’t remember it’s name, but you could probably use something like the $VIX above say 25 as a volatility stop. Of course, that is a discretionary move that should be recorded in your Investment Plan. It will probably degrade your edge, but it saves some angst in the short term.

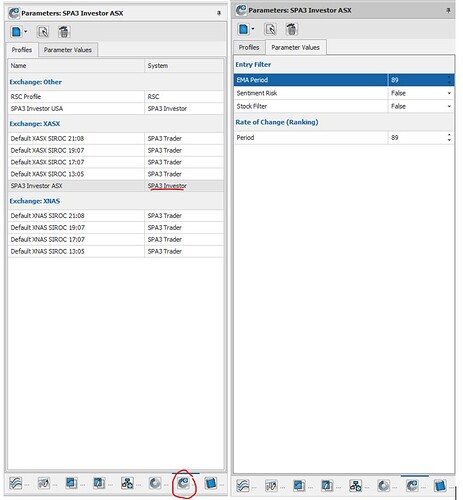

There is also in Beyond Charts under the Parameter Button the choice to activate the Sentiment Risk and Stock Filter by changing False to True

Hi Tim,

At the moment if you want to apply a Market Risk filter with SPA3 Investor it is the SPA3 Investor entry and exits signals on the $XAO & $SPX. SPA3 Trader uses these too. This requires you being vigilant of Low and High Market Risk status and ‘manually’ filtering out entering any new trades until MR turns to Low again.

Or you can turn on the Sentiment Filter in your SPA3 Investor parameters. This will automatically filter out entry SPA3 Investor entry signals.

As Phillip says, you can also use High Volatility MR, which is the ATRVE 21 rising above 3.5% on the XAO for the ASX and the SPX for US stocks.

Both are currently below 3.5 with the SPX having been above for a few days recently.

You are correct that all MR filters will degrade returns but will also reduce effort, drawdown, and the length & severity of emotional discomfort.

This is the eternal arm wrestle between reward and risk that rages in investors’ minds.

We are busy doing more research in this area for ways to improve the risk reward ratio when using a MR Filter. I am very interested to know from Members what their preference is, lower returns & less drawdown (less trading & effort too), or higher returns with deeper drawdowns?

Thanks Gary, yes that’s it, the sentiment filter. I shall take a look and apply that. My thinking is that this is not a permanent thing. In hindsight I should have applied it prior to the tariff implementation as like many I felt this was not going to go well. I shall turn the sentiment on until things settle down and a more settled trend starts to develop. At that point (approx I know) I shall return to the normal settings until the new improved Market risk filter comes in. I’ve felt very uncomfortable with the new trades coming through recently and in truth haven’t taken them all fearing the dead cat bounce and more losses to come. Like many I undoubtably feel the pain of losses 2x more than the pleasure of gains so with that in mind my answer to your question Gary is I would prefer lower drawdown even if it means a lower return. Your new indicator you previewed looks very promising.

Gary and Members, I’ve turned on the sentiment indicator to ‘true’ which as removed the recent buy signals from the ASX stocks but not the US stocks. Do I recall that US stocks don’t follow this methodology as they lose too much of their edge? Or is it me!

I’m having trouble finding information on what exactly the “USA Stock Filter” and “Sentiment Filter” are doing if they are turned on in a US Portfolio? They don’t seem to be covered in the Reference Manual.

Could someone please point me in the right direction.

The US stock filter can be found on the Parameters button on Beyond charts, to the left of the Parameter Values button called Profiles.

These filters were introduced during the market reaction to Covid and as an attempt to reduce the angst of trading the volatility. They remain as an option, but are turned off to increase the edge.

Thanks Phillip. I’ll look further back on the forum to Covid times for some more detail on what each does when turned on.

thanks Phillip, got it.

Hi guys, i have been playing around with simulator a bit and noticed that short term, 12 months and less, applying High MR filter had far better results. Didn’t note the difference but you can check for yourself. Longer term balanced out, 5 years and longer. Just as a matter of interest.

Is that applying the ‘sentiment filter’ or literally selling everything as soon as ‘high market risk’ is given for trader and not buying anything until ‘low market risk’ is signalled?

From memory, setting the Sentiment Filter to true will alter the buy and sell signals for the stocks. If a stock shows the last signal was a sell then you are meant to sell immediately, and if it shows the last signal was a buy, then you hold until a sell signal is generated.

Whatever you choose should be written into your plan and mechanically executed.

Someone may want to correct me on the above, as I don’t use the filter.

Colin, apologies if this has already been covered by Gary and I’ve missed it but would you be able to do a simulation of turning on the ‘sentiment indicators’ at high market risk and turning them off at low market risk. I’m wondering if this might be optimal? Miss the start of the upside but also miss the downside? Call it the ‘easy sleep’ indicator!![]()

On the app I can only access the ASX Stock Filter and the USA Stock Filter. I don’t see any access to the “Sentiment Filter”. Can any one tell me how to access the “Sentiment Filter” on the app?

The filters are on Beyond Charts, not the app afaik.

Good discussion. Some points to add.

When we run portfolio Simulations, the same portfolio rules and settings are obviously in place for the entire simulation period.

There is no doubt that applying a type of Market Risk filter over certain periods as an “easy sleep” indicator and then turning it off at the right time will improve results and also make active investing far easier.

The trick is having a set of objective criteria that determine when to turn the Sentiment (or any MR) Filter on and off.

This could be based on exhaustion criteria at either end. I’d recommend that they are NOT based on geopolitical events but technical criteria.

For example, exhaustion criteria to the downside might be turn off the MR Filter when the index has fallen by > 45% in a Secular Bear market and by > 20% in a Secular Bull market.

Exhaustion to the upside might be a delta above a certain EMA period or some other long term indicator.

As Phillip says, write this into your In Investment Plan. There is no one right way but there are many wrong ways. The right way is to think through with some research what the criteria are (keep it simple), document them and then follow them in the future.

Good chat indeed Gary. I’d love SWS to have some kind of notification for this as for those working full time it can be very hard to keep on top of quite technical parameters. My question is does the Trader High market risk and low market risk not do the job? If that cuts off too much of the oversold upside potential then I’d love another SWS signal.

For what it is worth, I use an EMA (eg 30 to 60) over my US equity curve. Weekly data seems to be less noisy, when my equity drops below the EMA, I reduce my new position size by 50% on new entries.

This worked quite well during Covid and is working this time around as well. reducing by 50% keeps you in the game, but reduces your risk. Revert to 100% risk on entry when equity goes back up and you are again in tune with the market.

Just another rabbit hole to go down!!

Cheers.

Interesting discussion for a very volatile period in the market. I turned my risk sentiment filter on to true and it would have kept me out of the RRL trade which has been a very good trade. Would this be correct or am I doing something wrong?