Good afternoon all,

Whether you’re trading on the ASX or the USA markets, you may find your portfolio not being as fully invested as it should be.

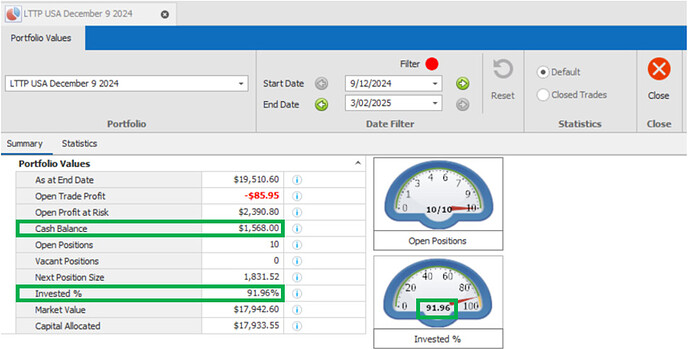

You can see this in the example below from the December LTTP USA portfolio where it is currently 91.96% invested, even though it is holding the maximum of 10 positions.

The remaining non invested cash balance is $1568.00 meaning that the portfolio is not running in an optimal state.

Summary Tab

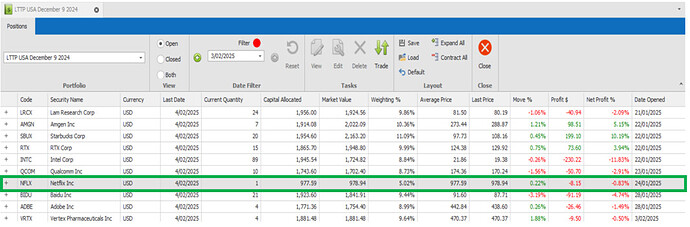

Positions Tab

Looking at the Positions Tab, you can see that Netflix (NFLX) is only carrying a weighting of 5.02% of the portfolio, much less than the other positions.

This is a trading mistake and according to the Skills Acquisition Plan, must be rectified immediately once noticed.

Discretion should not be used to decide when to rectify the mistake. Noticing it is the timing call to action.

How did this mistake occur?

In this instance, it was not making the conscious decision to increase the position size due to extra share being SO close (but over) the position size calculated by PM.

We had a sufficient cash balance available to manually overwrite it by increasing the quantity suggested from 1 to 2.

The Portfolio Manager will always round down to not exceed the Next Position Size value. With small portfolio values and hence position sizes, portfolios can lose divisibility, especially with high prices stocks like NFLZ at $977.

What to do?

To rectify this mistake, we will now be increasing the portfolio’s market exposure by purchasing an additional share of NFLX.

This trade will be executed as a Market On Close (MOC) order in the next market session.

To reflect this trade, the portfolio will be adding a new trade record after the order has been executed.

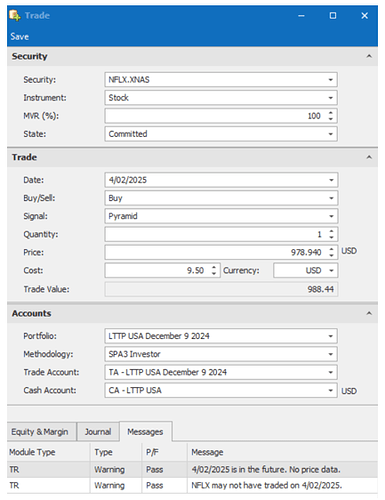

New Trade

Note that the signal for this trade will be a Pyramid, meaning that we are simply adding to an existing position.

This will cost extra brokerage for this trade.

Use this lesson to check your own portfolios as there are likely to be instances when this situation arises again.

When it does, you’ll be better placed to know what to do.

Importantly, we acknowledge the error and will be recording it in the journal of the trade record.