Q. I understand that if the price of the stock/ETF closes below the ATR_TS line an exit signal will be produced, so should I place a stop loss order on my broking platform at that ATR_TS level?

This is a personal choice, however in the initial research and in the live SWS Public portfolios no stop losses are placed in the market.

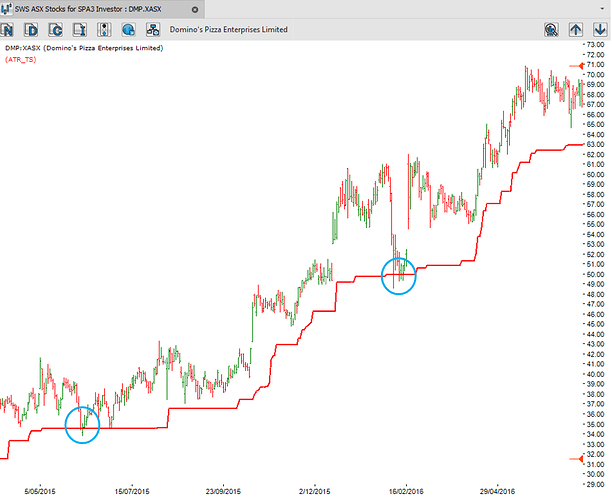

There will be times when the price may fall below the ATR_TS line intraday and yet close above that level at the end of the day, as can be seen in the chart of Dominoes (DMP) below.

In this case if a stop loss was placed in the market your position would have been closed, while the trade remains open as its price didn’t close below the ATR_TS.

This would have resulted in a premature exit, and a lost opportunity given the final outcome of the trade. For this reason the public portfolio investment plans do not set stop losses in the market, but rather exit the trade only when a sell signal has been generated.