Last Wednesday CWY received a “Sell” signal but I am confused about how this came about and I hope that someone in the SWS team can explain. My understanding is that the SPA3 Sentiment Risk is not in play for CWY or any ASX stocks but the SPA3 Stock Filter is the only means used to determine a buy or sell. So it appears that the SPA3 Stock Filter for CWY has remained at “1” which should mean “no sell” on Wednesday. Can someone please help me understand why this was a “sell”?

Hi Trevor,

Thanks for your post.

Just a point of clarification, the Stock Filter is only used for Entry signals. It has no bearing on exit signals at all.

There are two types of exit signals that members will see using SPA3 Investor. The most commonly produced exit signal is the ATR_TS.

This is generated when the closing price of the stock/ETF is lower than the ATR_TS price level.

The other exit signals are what we refer to as, “price action” exit signals. These are explained in detail in the Appendix of the SPA3 Investor Getting Started manual

The price action signals are early exit signals that will only trigger if they are above the ATR_TS.

In the case of CWY, the recent exit signal was generated by its closing price falling below the ATR_TS.

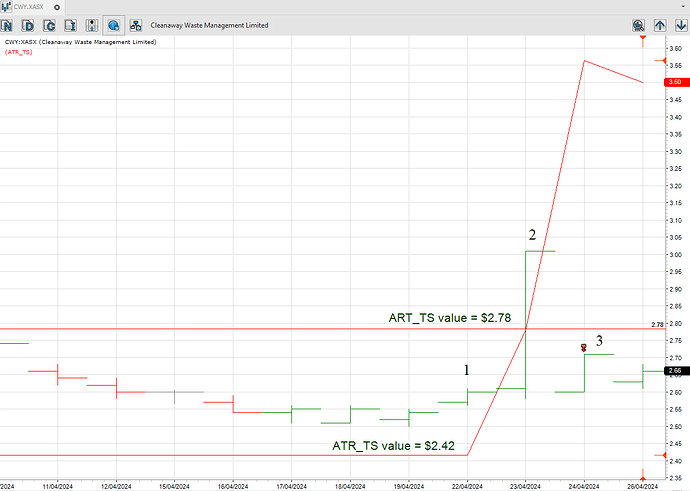

To see how this was caused, we need to enlarge the chart to see the events that lead up to the exit signal being generated.

Prior to the large increase in price (1) the ATR_TS was sitting at $2.42, below the closing price of $2.60.

On the day of the large price increase, (2) the ATR_TS “trailed” the price higher and settled at $2.78, below the CWY’s new closing price of $3.01.

The following day (3), CWY opened much lower at $2.60 and finally closed at $2.71. This price is lower than the ATR_TS at $2.78. Hence the exit signal shown in Beyond Charts and the App.

I trust that this helps to explain the exit signal in this case.

Regards,

David.

Thank you very much for your explanation. I wasn’t aware that the Stock Filter had no bearing on exit signals.

Cheers, Trevor

No problems at all Trevor… ![]()