Hi Gary hope you read this and reply. Yesterdays market update was interesting and totally agree we are at support world wide support levels and some large declines could occur below these levels. I was pretty convinced that falls would continue due to the economic situation around the world and geopolitical. Last night markets bounced on a UK intervention by the government and to my way of thinking it is rare that something that happens in the UK influences world markets. I am just left scratching my head how an index closes up so much on news that really does not solve any basic fundamentals of where the world is sitting as at the end of the day all markets seem to be following the US and yet Canada and Australia are commodity driven and they still follow the US. So a bounce off these support levels with last nights news in the UK just seems like a total over reaction. Am I missing something as next week we could get a “real smack in the chops”. Regards Pete

Peter,

We should never assume that any variable that is used in hindsight by any commentator to explain a market move is the one and only reason that the market did what it did.

The market often makes inexplicable moves and humans need to find an explanation to latch onto to reconcile and ‘square off’ the unknown.

In truth there would be many variables that led to todays bounce in the US stock market. Nearly all of which still remain unknown to everybody.

The needing to know and thinking that we know why things happen is one of our species biggest weaknesses.

It gets us to attach ourselves to what we think are truths. Any one of us or group of us will only ever know a tiny subset of the truth.

Which is why we can only react to (not predict what we think will happen) tangible outcomes that are highly measurable by data.

This also means not attaching ourselves to a notion that the market will fall into heap next week or take off like a rocket next month.

Everything is degrees of and probabilities and it is these on which we must focus and arrange our decision making around.

Being objective in an environment of high emotion and opinion is what gives us an edge over the herd.

A learning opportunity about “noise”, opinion and that “anything can happen” because there are just so many variables that interact in the market.

Loud variables (“noise”) that we become aware of, are mostly not what moves the market in either direction. We don’t know what all the other variables are and how they affect price action in the market.

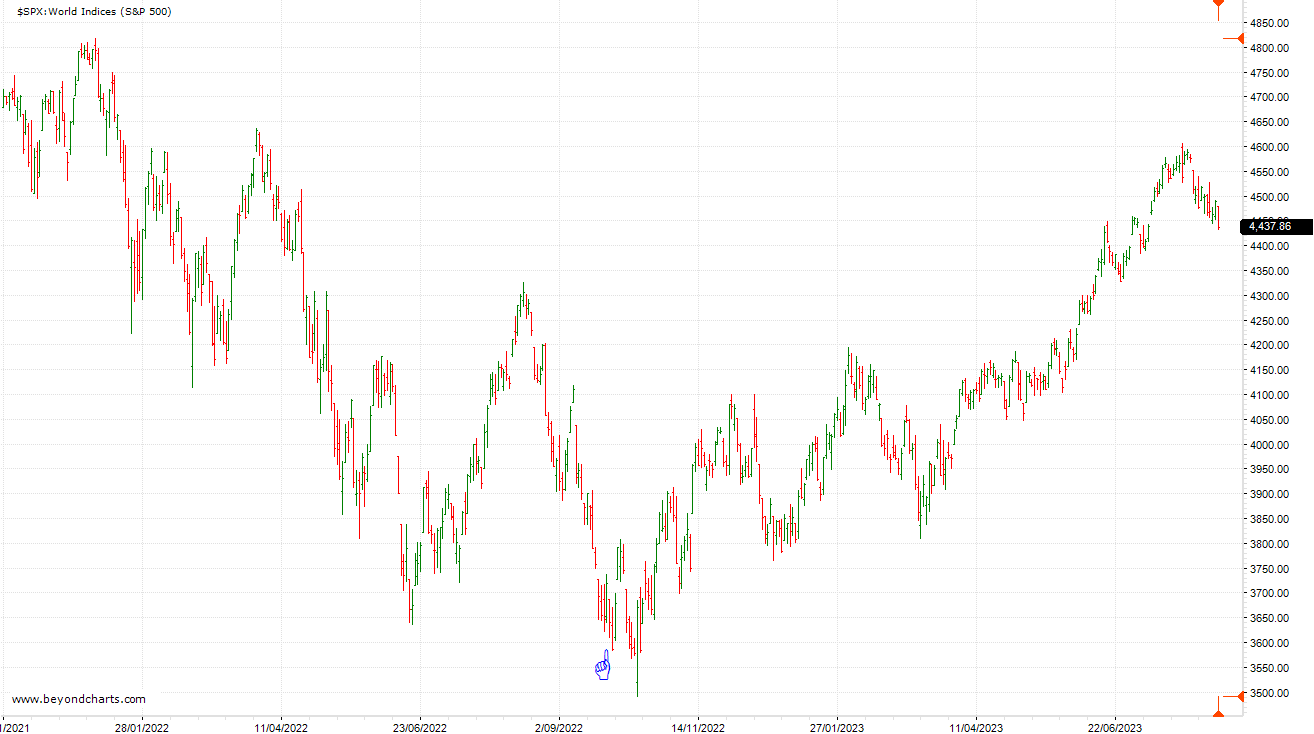

The blue hand at the bottom of the chart of the S&P500 shows the date of the above discussion, the 28 Sept 2022 trading session in the US, a big green bar.

Note what the S&P500 has done since.

Despite all the negative news that has filled our airwaves - The Wall of Worry.

Consider too, that “news” is mostly negative. It’s what makes the best headlines because ‘negative’ is what is most read by human beings…

Our aim is to be consistent.

And you can’t be consistent without being objective.

And you can’t be objective if your mind is continuously being swayed by opinion, one or a few variables, or by your emotional reactions to what you think will happen.

We become objective and consistent by allowing price to lead us.

Listen to the price action in the market, not the words of human beings in the news cycle. Price action includes all their words and all the other variables that you are not aware of…

Price is the language of the market and the tongue of the trade.

It continuously tells the story of trend in all timeframes…

You can watch Dave & I explain this in a 7 min video below: